Startup Fundraising Stages: The Complete 2025 Guide – From Seed to IPO

Tetiana Voronina

Pitch Deck & Presentation Strategist with a $125M+ Track Record | YC SS19

The biggest shock for a first-time founder is how one step turns you from a confident professional into a bumbling amateur in almost every field. One day you’re an expert, and the next you’re supposed to understand everything from financial models to legal jargon and the cryptic language of fundraising stages for startups. It’s hard not to feel like Homer Simpson enthusiastically tackling a project he knows nothing about when you start hearing terms like Series A, Series B, and Series C.

If you’re feeling this way, you’re not alone. The world of venture capital has its own language and its own ladder. Climbing it requires knowing the different funding round stages and what investors expect at each step. Understanding the various funding round types is crucial for navigating your journey to the top.

This guide will demystify the process. We’ll break down each of the fundraising stages, from a back-of-the-napkin idea to the final funding rounds before IPO.

What are the different stages of fundraising?

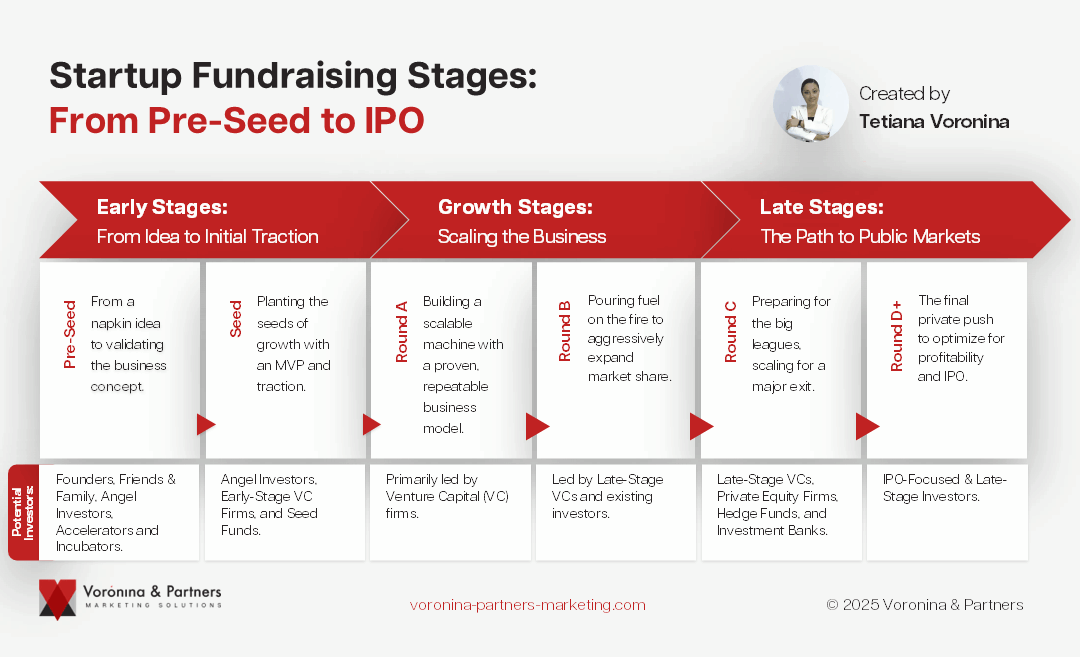

The journey from a simple idea to a public company is marked by several distinct funding round stages. Each stage corresponds to a different level of company maturity, with specific goals and investor expectations. The primary rounds of fundraising include Pre-Seed, Seed, Series A, Series B, Series C, and subsequent later-stage rounds, ultimately leading to a potential Initial Public Offering (IPO).

Early Stages: From Idea to Initial Traction

This initial phase is all about turning a concept into a viable business. It’s characterized by high risk, intense passion, and a heavy reliance on the founders’ vision and ability to execute.

Pre-Seed: The “Napkin Idea” Stage

- Business Stage:

Idea or Concept. You have an idea, maybe some initial research, but no product yet. This is the very beginning of the journey, where the primary goal is to determine if the idea has legs. - Company Focus:

The core activities revolve around validating the business idea, building a prototype or proof-of-concept, and conducting initial market research to understand the potential customer base and competitive landscape. - Key Metrics to Show:

Traditional business metrics are scarce here. Instead, the focus is on the narrative and the team’s potential. Investors will look for:- Founder’s background and expertise: Why are you the right person to solve this problem?

- A compelling vision and story: Can you paint a picture of a future where your company is a massive success?

- Initial market research and a rough estimate of the Total Addressable Market (TAM): How big is the opportunity?

- Typical Raise Amount:

Generally less than $1 million, often falling between $25,000 and $100,000. - Potential Investors:

This is often referred to as the “friends and family” round for a reason. Investors are typically the founders themselves, their close network, angel investors, and sometimes early-stage incubators or accelerators.

What Investors Are Funding: At this stage, investors are betting almost entirely on the team and the vision.

Seed Round: Planting the Seeds of Growth

- Business Stage:

You’ve moved beyond the napkin and have a Minimum Viable Product (MVP) with early signs of traction. This means you have a product in the hands of users or even a few early customers. - Company Focus:

The primary goals are to achieve product-market fit, build out the core team beyond the founders, and begin to refine the business model based on early feedback. - Key Metrics to Show:

- Early user numbers and engagement metrics.

- Initial revenue (if any).

- Customer feedback and testimonials.

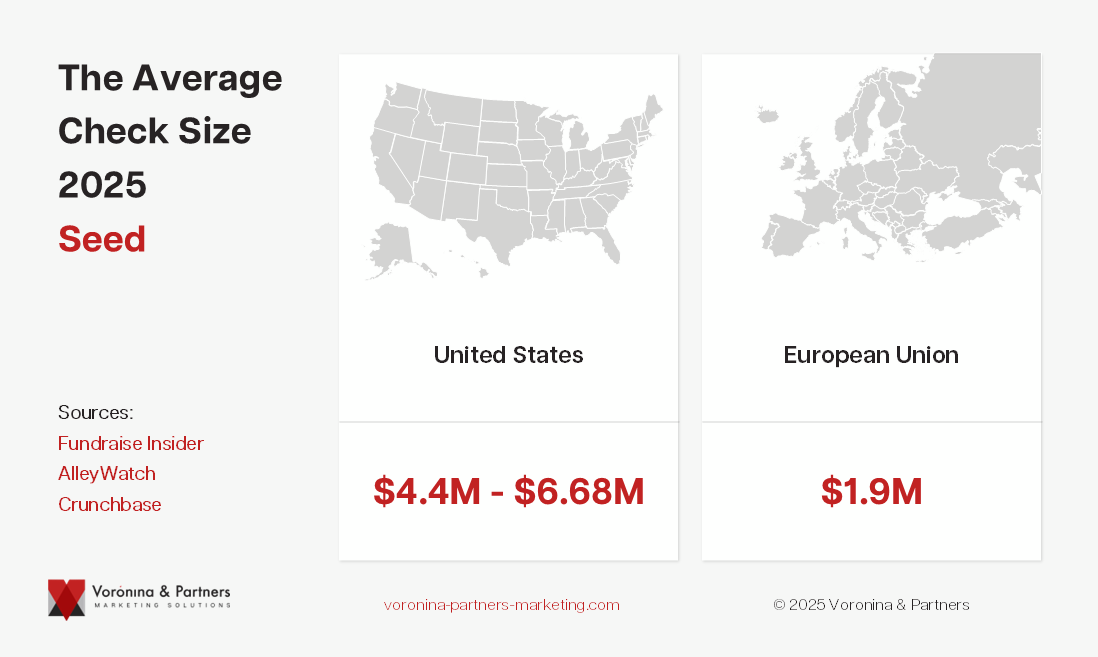

Typical Raise Amount (2025 Data):

- United States:

According to fundraising data from sources like Fundraise Insider and AlleyWatch, the average check size ranges from $4.4M to $6.68M, with the median between $3.0M and $4.18M. - European Union:

Based on reports from Crunchbase, the average check size is approximately $1.9M.

Potential Investors: Angel investors remain key players, but this is also where early-stage Venture Capital (VC) firms and seed-specific funds enter the picture. This is a critical one of the fundraising stages (a common query, also known as fundraising stages) that signals a startup’s potential.

What Investors Are Funding: Investors are now backing a product with demonstrated potential and a team that has shown it can execute and attract early adopters.

What are the rounds of fundraising for growth?

Once a startup establishes product-market fit, it enters the growth stage, characterized by a series of funding rounds known as Series A, B, and C. These different fundraising rounds are designed to inject significant capital to scale the business rapidly.

Growth Stage: Scaling the Business

Series A: Building a Scalable Machine

- Business Stage:

The company has a proven business model, a strong and growing user base, and consistent, repeatable revenue generation. - Company Focus:

The main objectives are to optimize the sales and marketing process, scale operations, and build a strong management team. - Key Metrics to Show:

- Consistent month-over-month revenue growth.

- Key performance indicators (KPIs) like Customer Acquisition Cost (CAC) and Lifetime Value (LTV).

- A clear and large addressable market (TAM).

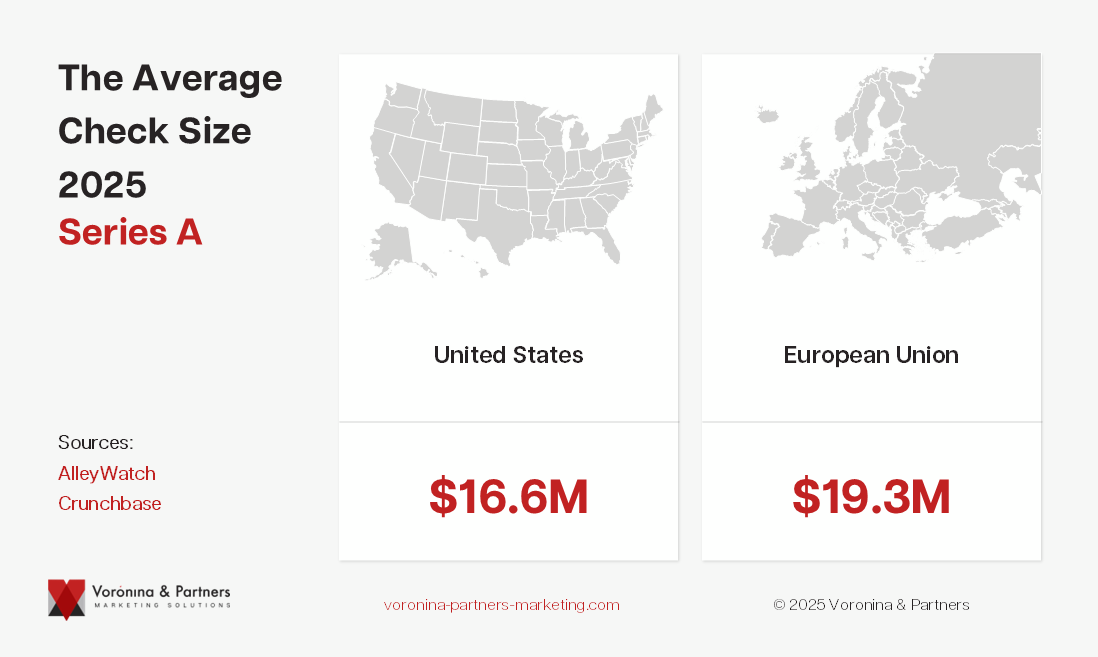

Typical Raise Amount (2025 Data):

- United States:

Per analysis from AlleyWatch, the average check size is $16.6M, with a median of $12.0M. - European Union:

According to Crunchbase data on early-stage rounds (covering Series A/B), the average is around $19.3M.

Potential Investors: Venture Capital firms become the primary investors, with a “lead investor” often taking a board seat.

What Investors Are Funding: VCs are investing in a business with a proven model that is ready to be scaled into a market leader.

Series B: Pouring Fuel on the Fire

- Business Stage:

The company has achieved significant market traction and is now a major player in its industry. - Company Focus:

The emphasis is on expanding market share aggressively, scaling the team significantly, and potentially exploring strategic acquisitions. - Key Metrics to Show:

- Strong and predictable revenue growth.

- A healthy and growing market share.

- Strong unit economics (LTV:CAC ratio).

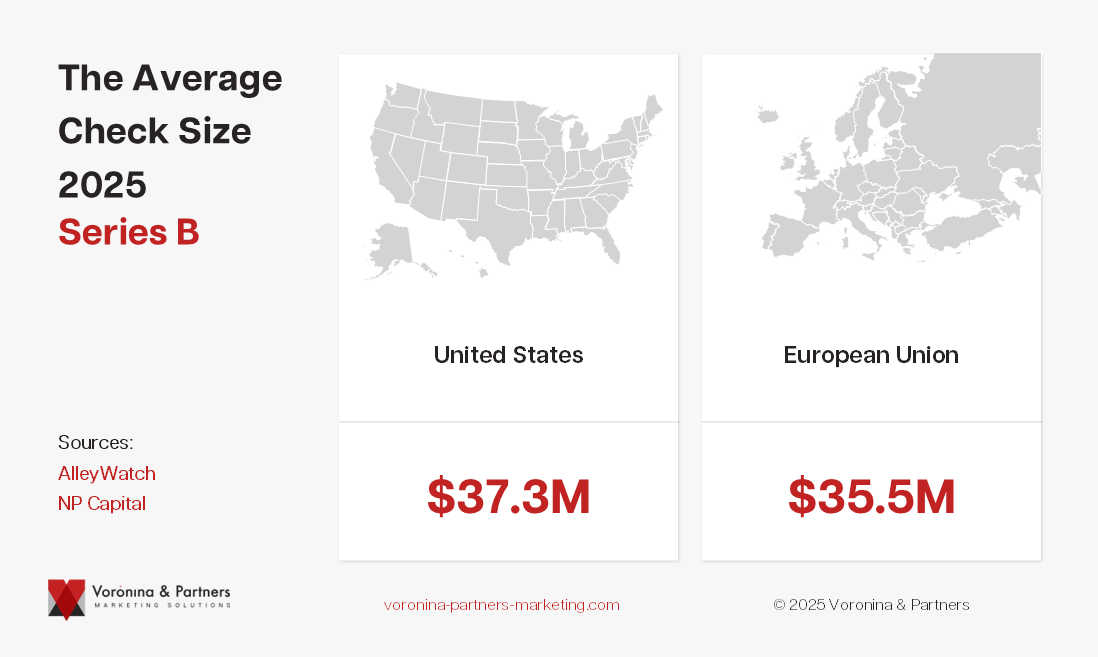

Typical Raise Amount (2025 Data):

- United States:

Data from AlleyWatch shows the average check size is $37.3M, with a median of $25.0M. - European Union:

For companies valued over $100M, analysis from NP Capital indicates the median check size is $35.5M.

Potential Investors: Late-stage VC firms often lead these rounds, with previous investors often participating to increase their stake.

What Investors Are Funding: Investors are backing a company that is demonstrably winning its market.

Series C: Preparing for the Big Leagues

- Business Stage:

The company is now a successful, late-stage startup with a very strong market position and, in many cases, is approaching or has achieved profitability. - Company Focus:

The strategic goals are often geared towards preparing for a major exit event, such as an Initial Public Offering (IPO) or a large acquisition.

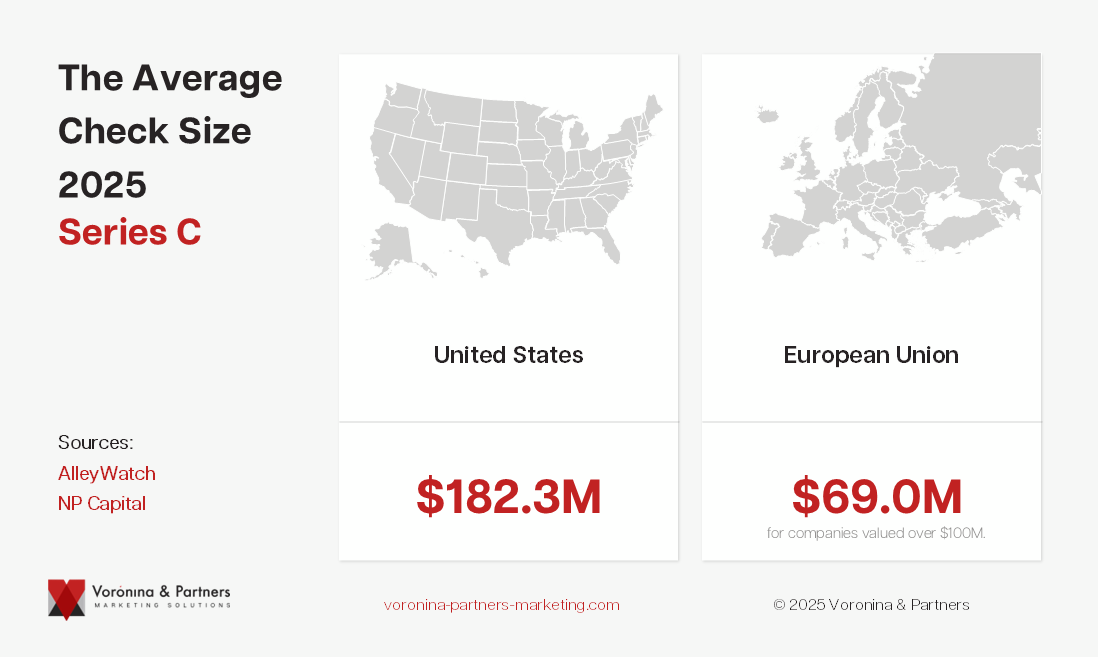

Typical Raise Amount (2025 Data):

- United States:

According to AlleyWatch, late-stage rounds (Series C and beyond) have an average check size of $182.3M and a median of $60.0M. - European Union:

Based on reporting from NP Capital, the median check size is $69.0M for companies valued over $100M.

Potential Investors: Late-stage VCs, private equity firms, hedge funds, and investment banks become the primary sources of capital.

What Investors Are Funding: Investors are backing a market leader that is on a clear path to an IPO or a major acquisition.

What are the various stages of funding before an IPO?

The final funding rounds before IPO are designed to prepare a company for the public markets. These late fundraising stages solidify the company’s financial standing and market dominance.

Late Stages: The Path to Public Markets

Series D and Beyond: The Final Private Push

- Business Stage:

The company is a well-established market leader that may need one final round of private funding before an IPO to hit key milestones or provide liquidity. - Company Focus:

The primary objectives are to optimize for profitability, solidify market leadership, and prepare for the rigorous processes of an IPO. - Key Metrics to Show:

- Strong profitability and a track record of generating profits.

- A dominant, undisputed market position.

- A world-class management team experienced in leading public companies.

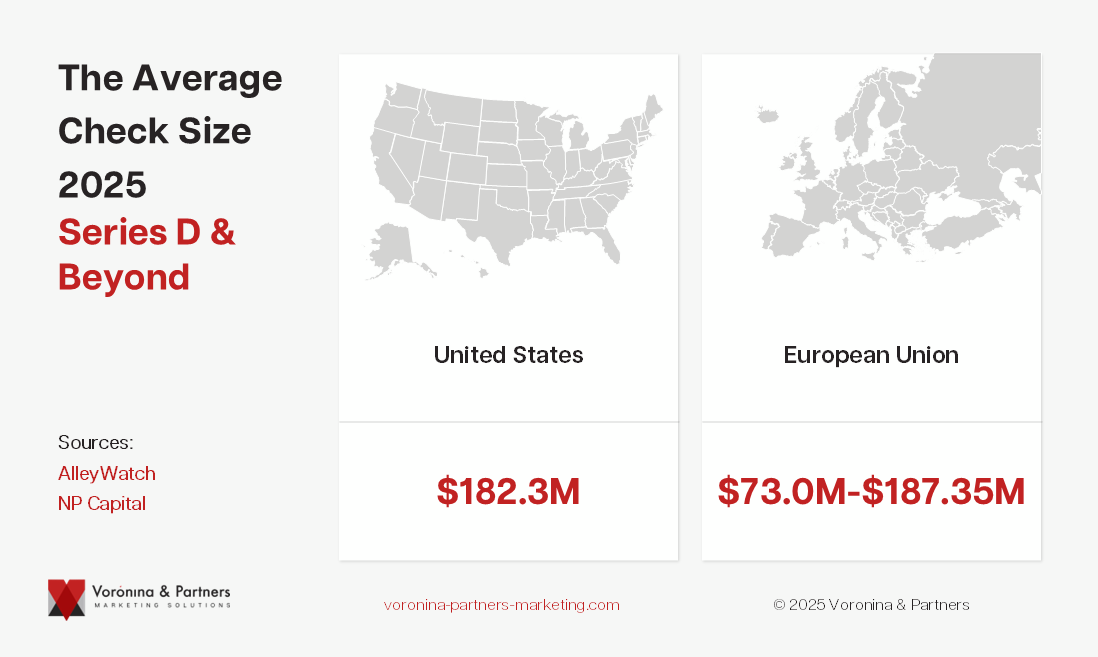

Typical Raise Amount (2025 Data):

- United States:

As part of late-stage funding, AlleyWatch reports these rounds average $182.3M with a median of $60.0M. - European Union:

Analysis from NP Capital shows median check sizes are $73.0M for Series D and $187.35M for Series E and beyond.

Potential Investors: The investor profile is similar to Series C, with an emphasis on those experienced in taking companies public.

Investors Fund: Investors are backing a company they view as a near-guarantee for a successful IPO.

Initial Public Offering (IPO): Going Public

- Business Stage:

The company is a mature, stable, and profitable enterprise ready to have its shares traded on a public stock exchange like the NASDAQ or NYSE. - The Process:

An IPO is not a funding round in the traditional sense but a complex, regulated process of selling shares to the public for the first time, in partnership with investment banks. - Potential Investors:

The pool expands dramatically to include the general public and large institutional investors. - Purpose:

The goals are to raise significant capital, provide liquidity for early investors and employees, and increase the company’s public profile and credibility.

Understanding Startup Valuation

Before any funding round, your company must be valued. This process determines what your business is worth and, consequently, how much equity you give away for the capital you raise. For early-stage and pre-revenue startups, valuation is more of an art than a science, blending qualitative factors with quantitative analysis.

Key Factors Influencing Early-Stage Valuation

- The Founding Team:

At the pre-seed and seed stages, investors are primarily betting on you. A team with relevant industry experience, technical skills, or a previous successful exit is a massive asset. - Market Size (TAM):

Investors want to see a large Total Addressable Market (TAM). A great idea in a small market has a low ceiling, but even a simple idea in a massive, growing market is exciting. - Traction and Product Stage:

While revenue isn’t expected, early signals of progress are critical. This can include a Minimum Viable Product (MVP), user waitlists, letters of intent from pilot customers, or strong user engagement data. - Competitive Landscape & IP:

A clear understanding of your competitors and a unique value proposition are essential. Any proprietary technology or intellectual property (IP) that creates a defensible moat will significantly increase your valuation.

Common Valuation Methods

While dozens of methods exist, a few are commonly used for early-stage companies:

- Comparable Company Analysis:

Often called “comps,” this method values your startup by looking at recent funding rounds or acquisitions of similar companies in your industry and region. - The Berkus Method:

Ideal for pre-revenue startups, this approach assigns a monetary value (up to $500,000 each) to five key risk factors: the soundness of the idea, the existence of a prototype, the quality of the management team, strategic relationships, and product rollout. - The Scorecard Method:

This method also compares your startup to similar funded companies but uses a weighted average. It starts with an average valuation for your sector and then adjusts it based on the strength of your team (30% weight), size of the opportunity (25%), product

Preparing for Your Funding Round: The Essential Documents

To successfully approach investors, you need more than just a great idea; you need to present it professionally. Authoritative sources like Y Combinator emphasize the need for a clear and compelling set of documents.

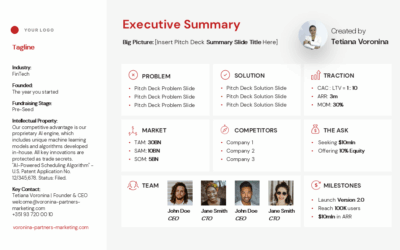

- The Pitch Deck:

This is your company’s story in a visual format. It should be a concise and compelling presentation that covers your vision, the problem you’re solving, your solution, the market size, your team, and your current traction. - The Business Plan:

While a full, 50-page document is less common now, you need a detailed plan that outlines your strategy. This includes your go-to-market plan, operational strategy, and a clear description of your business model and how you’ll generate revenue. - The Financial Model:

This is the spreadsheet that backs up your story with numbers. It should include your key assumptions, financial projections (revenue, expenses, cash flow), and an overview of your fundraising needs and how the capital will be used.

Beyond Venture Capital: Alternative Funding Avenues

While VC funding dominates headlines, it’s not the only path and often not the right one for every business. Understanding your alternatives is crucial for making the best strategic decision for your company.

- Debt Financing:

Unlike equity financing, where you sell ownership, debt financing is a loan that must be repaid with interest. This allows you to retain full ownership and control. Options include:- SBA Loans: Government-backed loans from the Small Business Administration (SBA) can offer favorable terms but often have stringent requirements.

- Venture Debt: A type of loan for venture-backed startups, typically raised alongside or after an equity round to extend runway with minimal dilution.

- Revenue-Based Financing (RBF): A flexible loan where repayments are a fixed percentage of your monthly revenue, making it adaptable to your performance.

- Grants:

These are non-dilutive funds (meaning you don’t give up equity) awarded by governments, corporations, or foundations. They are highly competitive but are essentially free money to help you grow. Programs like the Small Business Innovation Research (SBIR) grants are a popular option for tech-focused startups. - Crowdfunding:

Platforms like Kickstarter (rewards-based) or StartEngine (equity-based) allow you to raise capital from a large number of individuals. This can be a great way to validate your product and build a community around your brand. - Angel Investors and Friends & Family:

These individual investors are often the first external capital a startup receives. They invest their own money and are typically more flexible than institutional VCs, often investing based on their belief in the founder.

Conclusion

Viewing fundraising not as a sprint but as a marathon is the strategic shift that separates seasoned founders from novices. When a founder understands the complete map of fundraising stages, they stop chasing quick cash and start playing the long game. They can strategically plan, not just for the next round, but for the entire journey.

A critical piece of this long-term strategy is the art of building and growing investor relations. Your investors become more than just lines on a cap table; they transform into a council of partners. By deliberately cultivating these relationships, a founder makes the entire process smoother and more supportive. This is how a founder transforms-from an entrepreneur overwhelmed by the process to a confident leader, ready to guide their venture all the way to the top.

About Author

Tetiana Voronina is a Pitch Deck and Presentation Strategist, Founder and CEO of Voronina & Partners Marketing Solutions, and a YC SS19 attendee. She specializes in comprehensive fundraising preparation, crafting the compelling narratives that have cumulatively raised $125M+ in funding.