The Founder’s Playbook: How to Write a Startup Executive Summary for Pre-Seed, Seed & Series A (+ Templates)

Tetiana Voronina

Pitch Deck & Presentation Strategist with a $125M+ Track Record | YC SS19

Crafting an executive summary is your moment to shine in the fundraising environment. Think of it as the “movie trailer” for your business. For the time-starved investor reviewing hundreds of decks, it’s the sole determinant of whether they click “next” or close the tab forever.

Most founders get it wrong. They write a summary of their company. You need to write a summary of an investment opportunity.

This playbook will show you how to architect the perfect executive summary for each critical fundraising stage, from initial concept to scalable growth.

The Universal Structure: 9 Components of Every Great Executive Summary

Before we break it down by stage, understand that every winning summary is built on a timeless foundation. These are the nine essential components investors expect to see.

1. The Opening Hook:

A single, powerful sentence that defines your company, the problem you solve, and the scale of the opportunity. It must immediately answer, “Why now?”

2. The Problem:

A clear and visceral description of the pain point you are solving. Quantify it with data or a relatable anecdote.

3. The Solution:

A high-level overview of your product, framed as the definitive answer to the problem. Focus on the unique value, not just the features.

4. Market Opportunity (TAM, SAM, SOM):

Quantify the size of your market to show investors the ultimate prize.

5. Your Competitive Advantage:

What is your “moat”? Clearly articulate what makes your venture defensible against competitors.

6. The Business Model:

How do you make money? Detail your pricing strategy (e.g., tiered subscriptions, usage-based, etc.).

7. The Team:

Go beyond titles. Highlight the specific, relevant experience that makes your team uniquely qualified to win.

8. Traction & Milestones:

Showcase what you’ve already achieved (e.g., a prototype, early revenue, key hires) and your roadmap for the future.

9. The Clear “Ask”:

State the exact amount of capital you are raising and provide a high-level breakdown of how you will use the funds.

The Fundraising Playbook: Tailoring Your Summary for Each Stage

The story you tell evolves as your company matures. Here’s how to tailor your executive summary for each funding round.

The Pre-Seed Summary: Selling the Vision

- The Goal: To validate your concept and sell the dream.

- The Narrative Focus: The Founder’s Story. At this stage, investors are betting on you. Your summary must convey a compelling founder-market fit. Why are you the only person in the world who can solve this problem?

- What to Highlight: Since you have no revenue, focus on conceptual traction: a working prototype (MVP), a growing waitlist, positive customer interviews, or Letters of Intent (LOIs) from potential customers.

The Seed Stage Summary: Proving the Hypothesis

- The Goal: To prove you have achieved initial Product-Market Fit (PMF).

- The Narrative Focus: The Customer’s Story. The story now shifts from “we have a great idea” to “we have a product that a specific market loves and is willing to pay for.”

- What to Highlight: Data is now essential. Showcase early but meaningful quantitative traction:

- Monthly Recurring Revenue (MRR): Typically $5k – $25k+

- MRR Growth Rate: Shows momentum.

- Early Customer Logos & Testimonials: Provides powerful social proof.

The Series A Summary: Engineering for Scale

- The Goal: To prove you have a repeatable, scalable, and profitable growth machine.

- The Narrative Focus: The Business’s Story. The summary becomes a data-driven argument. You’re no longer selling a dream; you’re presenting a predictable engine ready for fuel.

- What to Highlight: Sophisticated SaaS metrics are now the language you must speak:

- Annual Recurring Revenue (ARR): Typically $1M+

- Net Dollar Retention (NDR): >100% is the goal.

- LTV:CAC Ratio: A healthy 3:1 or better is the industry standard.

- CAC Payback Period: <12 months is considered strong.

Don’t Start From Scratch: Download Your Stage-Specific Templates

Architecting the perfect summary for each stage is complex. We’ve built the blueprints for you, based on our experience with founders who have raised over $125M.

The Text-Based Summary Pack

Get a complete, fill-in-the-blank executive summary template, with specific versions tailored for your Pre-Seed, Seed, or Series A round. Includes prompts for every section to ensure your narrative is perfect.

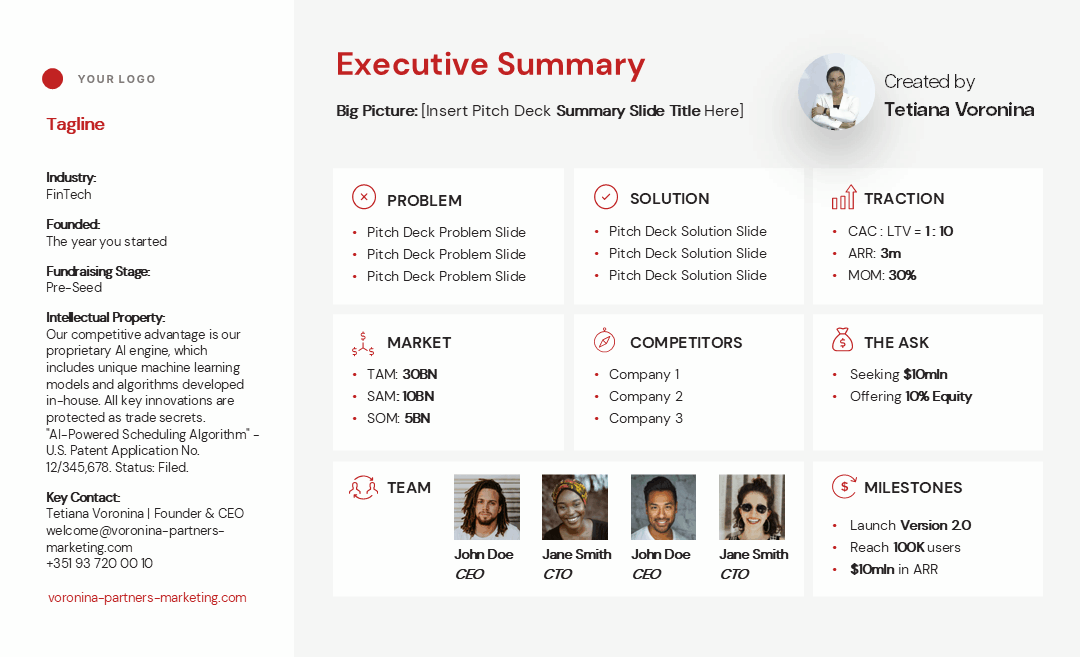

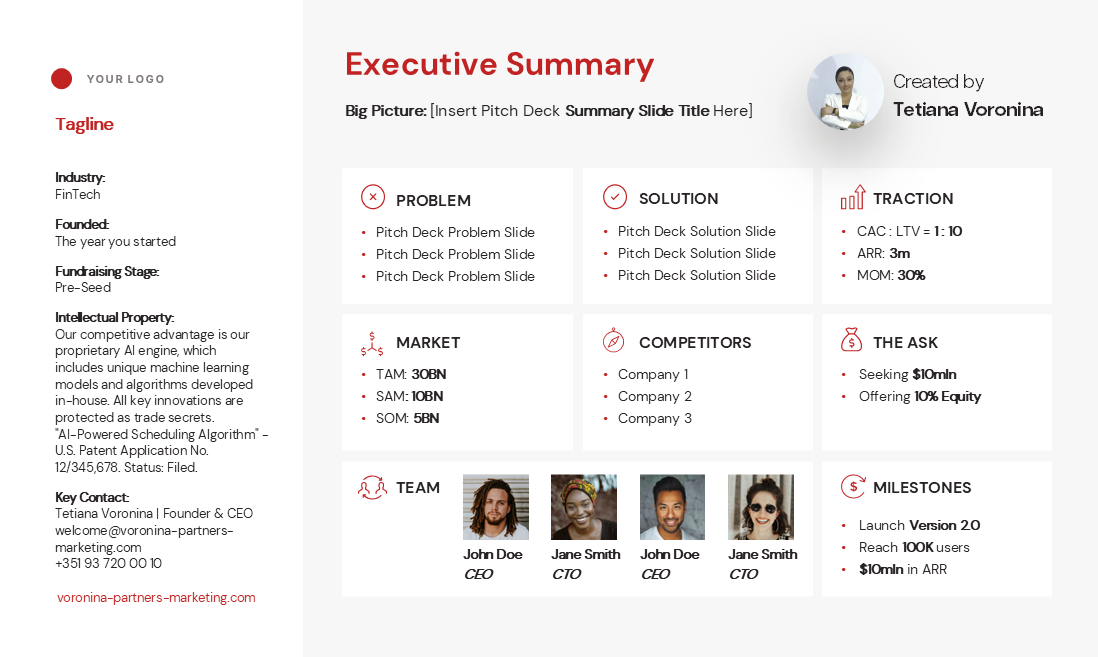

The Visual Summary Template

Get our universal, one-page visual template (a “teaser” slide). It’s designed for maximum impact and is the perfect tool for initial investor outreach emails and quick introductions that demand attention.

Pro-Tip: Use the Right Tool for the Job (Text vs. Visual)

Your executive summary exists in two forms. Knowing when to use each is a strategic advantage.

- A Visual Summary (a single, powerful pitch deck slide) is your opener. Use it to get the meeting.

- A Text-Based Summary (a 1-2 page document) is your follow-up. Provide it for due diligence and formal review.

Lead with the visual to capture interest, then provide the text-based document to seal the deal.

Startup Executive Summary: FAQ

What are the key components of a startup executive summary?

A comprehensive executive summary should provide a high-level overview of your entire business. The key components typically include: The Problem/Opportunity, Your Solution, Market Analysis, Competitive Advantage, The Team, a Financial Summary, and a clear “Ask.”

What should be avoided in an executive summary?

Avoid jargon and acronyms that an outside reader wouldn’t understand. Steer clear of vague claims and focus on concrete data. Most importantly, avoid typos and grammatical errors at all costs, as they signal a lack of professionalism. Finally, avoid making it too long—conciseness is critical.

How long should an executive summary be?

The ideal length for a text-based executive summary is one to two pages maximum. For a visual summary, it should be a single, impactful slide. The goal is to convey the most critical information as efficiently as possible.

When should you write the executive summary?

Always write it last. Only after your entire pitch deck is complete can you accurately summarize its most important points and ensure the narrative is consistent.

About Author

Tetiana Voronina is a Pitch Deck and Presentation Strategist, Founder and CEO of Voronina & Partners Marketing Solutions, and a YC SS19 attendee. She specializes in comprehensive fundraising preparation, crafting the compelling narratives that have cumulatively raised $125M+ in funding.