The Founder’s Compass: Guide to Finding Startup Investors in 2025

Tetiana Voronina

Pitch Deck & Presentation Strategist with a $125M+ Track Record | YC SS19

For a new founder, the world of startup investors can seem straightforward, defined by the classic distinction between angel investors and venture capitalists. While this foundational knowledge is a good starting point, the fundraising landscape has evolved dramatically. Today, securing capital requires navigating a nuanced and dynamic ecosystem shaped by new investor archetypes, collaborative funding models, and a significant concentration of wealth in specific sectors.

This guide moves beyond the basics to provide a strategic blueprint for founders, offering a comprehensive and actionable roadmap to securing capital in the modern era.

The Classic Distinction: A Refresher

The traditional model correctly differentiates between two key players. Angel investors are affluent individuals who deploy their own capital, often taking on more risk for early-stage companies. They tend to be less involved in the day-to-day operations and are more focused on the potential of an interesting idea.

In contrast, venture capitalists (VCs) are professionals who manage large funds on behalf of a risk capital firm, investing other people’s money. VCs typically seek a larger equity stake and a higher degree of operational control in exchange for a more significant investment.

While this distinction remains valid, it is no longer sufficient to understand the full scope of the market.

New Players and Collaborative Models

To effectively fundraise in 2025, founders must understand the rise of new capital sources and innovative structures that are reshaping the ecosystem. This guide helps founders understand the diverse types of investors for startup companies.

Family Offices: These private wealth management advisory firms, which serve a single wealthy family, represent a distinct and increasingly important source of capital. Unlike institutional asset managers bound by strict frameworks and performance metrics, family offices prioritize flexibility and long-term value creation. This makes them ideal partners for founders seeking patient capital and strategic alignment over a rigid, short-term exit plan.

Corporate Venture Capital (CVC): These investment arms of large corporations often make strategic investments that align with the parent company’s business goals, in addition to seeking a financial return. A major trend since 2023 is the pivot of corporate venture arms away from traditional enterprise software and heavily toward AI-related startups. For instance, Microsoft’s M12 venture arm has made a striking shift to exclusively AI-focused investments in the first half of 2025.

Alongside these new players, collaborative funding models have emerged to simplify the fundraising process for founders.

Angel Syndicates and Special Purpose Vehicles (SPVs): An angel syndicate is a collective of individual investors who pool their resources to back a single startup, led by an experienced investor. The legal entity used to facilitate this is an SPV, a short-term vehicle that aggregates capital and appears as a single line item on a company’s cap table. This model dramatically streamlines the fundraising process for founders by reducing the administrative burden of managing dozens of individual investors. It also creates a “clean cap table,” which is highly appealing to investors in future funding rounds, making the company more “fundable”.

A Macro View: The 2025 Funding Climate

The venture capital landscape in 2025 presents a nuanced picture of both recovery and concentration. The first half of the year marked a significant milestone, with global startup funding reaching its strongest half-year since the first six months of 2022, signaling a tentative recovery driven by renewed exit activity and improved market sentiment.

However, this recovery is not evenly distributed. A staggering concentration of capital is flowing into the artificial intelligence (AI) sector, particularly for a handful of mega-deals. Nearly one-third of all venture capital investment in Q2 2025 went to just 16 companies that raised funding rounds of $500 million or more, many of which were in the AI sector. Data shows that VC dollars invested in AI are on pace to exceed all previous years, with AI-related investments accounting for 51% of total VC deal value in H1 2025, compared to just 12% in 2017. The United States remains a dominant force, accounting for an impressive 83% of the total transaction value in AI-related deals.

This market dynamic creates a paradox: while institutional capital is consolidating into massive, centralized funds that chase high-risk AI opportunities, a parallel ecosystem is emerging where capital is fragmented and decentralized through the rise of syndicates and SPVs. For founders, this means the primary strategic decision is now to determine which of these two parallel ecosystems their business belongs to.

The Founder’s New Arsenal: Tools for Investor Sourcing

In the modern fundraising environment, a founder’s strategy must be a two-way street. While founders must use data to find potential investors, a complementary trend has emerged in which investors are increasingly using AI-driven tools to find founders. Venture capital firms now leverage sophisticated AI algorithms to automate their deal sourcing and due diligence, identifying startups that fit their specific thesis by filtering millions of data points across platforms like Crunchbase, AngelList, and LinkedIn. This creates a new mandate for founders: their digital footprint is now a data set that must be optimized for these AI-driven systems.

The following table provides a concise, at-a-glance comparison of the leading investor sourcing platforms, which both founders and investors use to navigate this new landscape.

Investor Sourcing Platform Pricing and Feature Comparison

| Platform | Pricing Tiers | Key Features | Ideal Use Case |

|---|---|---|---|

| Crunchbase | Basic: Free; Starter: ~$29/user/mo; Pro: ~$49/user/mo; Enterprise: Custom | Pro offers unlimited CSV exports, 100+ advanced search filters, verified contact data, and market trend analysis. The platform has extensive profiles on companies, funding rounds, investors, and acquisitions | Founders needing affordable, broad market intelligence. Sales and business development teams using the Pro tier for prospecting and lead enrichment. |

| Dealroom.co | Starter: €12,000/year (3 seats); Team: €20,000/year (6 seats); Corporate: €40,000/year (20 seats) | The database includes over 3 million companies and more than 190,000 investors. It features predictive signals, founder strength scoring, and advanced industry taxonomy, with a strong focus on the European ecosystem and API integrations. | VCs, corporate M&A, private equity, and government innovation agencies requiring deep, verified data for deal sourcing and market mapping. |

| Gritt.io | Free: Limited searches; Basic: ~€40/mo; Advanced: ~€80/mo (adds AI email generation); Ultimate: ~€150/mo (adds CSV exports) | The database has approximately 45,000 investors with enriched contact details. It provides AI-powered investor recommendations and built-in CRM for managing outreach. | Early-stage founders who want an all-in-one, AI-assisted platform to find and manage investor relationships. |

| Investor Scout | Subscription plans or one-time Lifetime Deals (e.g., ~$69) | The database contains over 52,000 investors, including VCs, angels, and private equity funds. A core feature is providing direct contact information. | Founders on a budget who need a simple database of investor contacts for manual outreach campaigns without a recurring subscription. |

| Invstor.com | Free to search; paid membership required to contact (starting at ~$59/mo) | It's a network/marketplace where entrepreneurs can post funding requests. The database includes various capital sources beyond just VCs. | Entrepreneurs exploring a wide range of funding options and are open to paying a fee to connect with them. |

| OpenVC | OpenVC: Free; OpenVC Plus: $99/month or $299/year. | A free, community-sourced database of VC firms that focuses on presenting a clear investment thesis. | Bootstrapped and very early-stage founders who need a no-cost starting point for investor research. |

| Growjo | Free (limited data); Premium plans for full access and exports | Ranks the top 10,000 fastest-growing companies globally. Provides data points like employee growth, funding news, and estimated revenue. | B2B sales/marketing teams, recruiters, and VCs looking for high-growth lead signals. |

| Unicorn Nest | Free trial; paid plans available | An all-in-one fundraising toolkit with an investor recommendation system and built-in relationship management (CRM). | Founders who want a single, integrated software to manage a data-driven fundraising campaign. |

| Acquire (.com) | Free to list a startup; success fee upon closing | The largest marketplace for buying and selling startups, with over $500M in closed deals. It provides tools for valuation and anonymous listings. | Founders looking for a strategic exit by selling their company. |

| Mattermark | Standard: ~$49/user/mo; Professional: Custom/Quote-based | The database includes over 4 million companies with more than 80 data points. It features "Growth Signals" to identify fast-growing companies and offers integrations with Salesforce and Google Sheets. | Professional users (VCs, enterprise sales, private equity) needing a robust data engine for complex lead scoring, deal sourcing, and market analysis. |

From Theory to Traction: A Founder’s Action Plan

Beyond understanding the market and its tools, fundraising success hinges on a few core, timeless principles.

Crafting a Compelling Pitch

A winning pitch is more than a deck; it’s a narrative that answers three core questions: “What specific problem exists?”, “Why is it urgent and painful?”, and “What does winning look like?”. This narrative should also address the “Why you, why now, and what’s happening” framework, explaining why your team is uniquely positioned to succeed and what macro trends will accelerate your company’s growth. For pre-seed and seed rounds, the focus is on the team, product, and market opportunity, while later rounds demand evidence of traction, such as revenue growth and customer base.

The Enduring Power of the Network

In a landscape increasingly driven by data, the human element of fundraising remains paramount. Relationships are a founder’s most valuable asset. Warm introductions are a far more effective way to secure a meeting than a cold email. Platforms and accelerators, like Y Combinator and the Founder Institute, are not just sources of capital; they are powerful networks that provide access to investors, peers, and mentors who can offer strategic advice and open doors. A founder’s reputation is a crucial part of their brand, and avoiding burning bridges is essential in the small world of venture capital. Persistence is also key; the journey will involve dozens of meetings, and rejection is part of the process. Founders should be prepared for this and see it as an opportunity to refine their pitch.

Harnessing AI to Accelerate Your Raise

As investors increasingly rely on AI to source deals, founders can use these tools to their advantage. A forward-looking founder should leverage AI to optimize their fundraising process, from pitch refinement to investor identification. AI can analyze a founder’s financial models and pitch decks, mirroring the way VCs use these tools for their own due diligence. By doing your homework on a potential investor’s portfolio and investment thesis before a meeting, you can ensure you are as prepared as the investors you are pitching to.

A Founder’s Action Plan: A Step-by-Step Guide to Raising Capital

Based on the comprehensive research, here is a step-by-step action plan for a founder to improve their fundraising strategy and successfully secure capital from startup investors.

Step 1: Lay the Foundation Before the Raise

Before you begin outreach, you need to ensure your company and your narrative are “fundraise-ready.”

Validate Your Business Idea: Go beyond your initial concept. Engage in market research, conduct surveys, and talk to potential customers to confirm a real market need for your product. You should be able to answer four key questions: “Who will buy it and why?”, “Do you make money per unit?”, “How much can you sell?”, and “Can you protect your profits?”.

Create a Compelling Narrative: A great pitch answers a core set of questions. Start with “What specific problem exists?” and “Why is it urgent and painful enough that people are desperate to solve it?”. Then, explain “What does winning look like?” if you successfully solve this problem. You must also articulate why your team is uniquely positioned to succeed and what macro trends make this the right time for your solution.

Formalize Your Business: Get your legal and financial house in order. This includes incorporating, retaining a business lawyer, opening a bank account, and drafting essential founder documents.

Step 2: Strategize Your Fundraising Process

Once your foundation is solid, you can create a tactical plan for your raise.

Determine How Much to Raise: Use a “milestone-backwards” approach. Figure out the next major milestone that will attract a Series A investment (e.g., reaching $1M in annual recurring revenue or securing your first ten enterprise clients). Then, calculate the capital needed to achieve that goal within an 18-24 month period, allowing for a 30% buffer for unexpected pivots.

Build a Targeted Investor List: Don’t just cast a wide net. Research and target investors who have a history of investing in your specific industry and stage. Look beyond traditional VCs to include family offices, corporate VCs, and angel syndicates, which have become increasingly important sources of capital.

Leverage Sourcing Platforms: Use professional platforms to identify and research potential investors. Platforms like Crunchbase, PitchBook, and AngelList can help you find investors based on their portfolio, location, and investment focus.

This is where you make contact and build a connection. Your approach can take two primary forms: a warm introduction or a strategic cold outreach.

Step 3: Execute Your Outreach and Pitch

The Power of Warm Introductions

A warm introduction from a trusted source is the most effective way to get an investor’s attention.

💡 The Founder Goldmine: Your most valuable source for warm intros is often other founders. It’s much easier to connect with a peer than a VC. For a powerful warm intro, try this:

- Identify a target investor.

- Look at their portfolio on their website.

- Find a founder of a non-competing company they’ve funded and reach out to them. A concise, respectful request for a 15-minute chat about their experience with that investor can lead to a powerful introduction.

Making Cold Outreach Work

While warm intros are powerful, a strategic cold outreach campaign can also be highly effective—if your approach is right. A generic email blast will fail. The key is a professional, personalized message that includes your research “hook” and a compelling Investment Teaser.

Best Practices for Engagement

- Manage Your Funnel Systematically: Keep track of every interaction. Use a structured system like Notion to manage your investor outreach, meeting schedules, and follow-ups.

- Pitch as a Conversation: Use your pitch deck as a guide for a dialogue, not a monologue.

- Seek Feedback and Stay Persistent: Fundraising is an intensive process, and rejection is part of the journey. If an investor passes, ask for constructive feedback to refine your pitch.

Step 4: Close Your Round

Understand the Term Sheet: When you get an offer, be prepared to review and negotiate the term sheet. Familiarize yourself with key terms like pre/post-money valuation, investor control, board seats, and liquidation preferences.

Communicate Effectively: Once you have a term sheet in hand, it is appropriate to notify other investors you have met with to let them know you have received an offer. This can help accelerate their process if they are still interested.

Step 5: Leverage Your Network and Accelerators

Join a Community: Consider applying to an accelerator program like Y Combinator or the Founder Institute. These programs can provide not only capital but also invaluable mentorship and a powerful network of peers and investors.

Build Your Reputation: The venture capital world is smaller than it seems, and a founder’s reputation is a crucial part of their brand. Always aim to build and maintain relationships, as this network can unlock future opportunities.

Empower Your Fundraise

By leveraging this strategic compass, you empower yourself to navigate the fundraising landscape with confidence. The process requires a systematic approach and a suite of professional, interconnected documents.

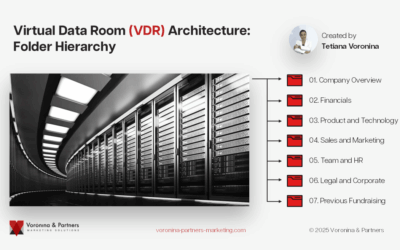

The SaaS Launchpad by Voronina & Partners provides the complete toolkit discussed in this guide, including the Pitch Deck, Financial Model, Executive Summary, Investment Teaser, and Notion VDR, all designed to work together to present a credible and compelling case to investors.

Conclusion

The fundraising landscape for startups in 2025 is more complex than ever, but it is also full of new opportunities. A truly authoritative resource must acknowledge this complexity and provide founders with a multi-faceted strategic plan. By understanding the new investor archetypes, leveraging collaborative funding models, and mastering the new data-driven tools, founders can move beyond the conventional wisdom of “angels versus VCs” and equip themselves with the knowledge and network needed to successfully find startup investors and build a thriving business.

FAQ

Where to find startup investors?

You can find investors through a variety of channels, including online databases like Crunchbase and Investor Scout, community platforms like AngelList, and by networking at industry events and through social media platforms like LinkedIn and X (Twitter).

How to get investors for a startup?

To get investors for your startup, you must go beyond simply finding names. You need to present a compelling, data-backed story, have a professional set of assets like a Pitch Deck and Financial Model, and build a long-term network of relationships.

What is the difference between angel investors and venture capital firms?

Angel investors are typically high-net-worth individuals who invest their own money, often at the pre-seed stage. Venture Capital (VC) firms invest managed funds from limited partners and typically write larger checks at the seed stage and beyond.

How to find angel investors for my startup?

Angel investors can often be found through specialized platforms like Gritt.io and AngelList, as well as through industry-specific accelerators. Personal referrals and networking within your business community are also highly effective methods.

About Author

Tetiana Voronina is a Pitch Deck and Presentation Strategist, Founder and CEO of Voronina & Partners Marketing Solutions, and a YC SS19 attendee. She specializes in comprehensive fundraising preparation, crafting the compelling narratives that have cumulatively raised $125M+ in funding.