From Seed to Scale: A Guide to Fundraising Prep for Pre-Seed, Seed, and Series A

Tetiana Voronina

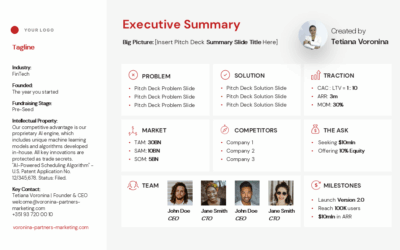

Pitch Deck & Presentation Strategist with a $125M+ Track Record | YC SS19

For any founder, the journey from a groundbreaking idea to a thriving enterprise is paved with critical funding milestones. Understanding the distinctions in the pre seed vs seed funding debate, as well as how that differs from a Series A, is fundamental. But knowing how to prepare for each is what truly leads to success. This guide breaks down these different fundraising stages, explaining what investors expect and how you can prepare to successfully raise capital at each step.

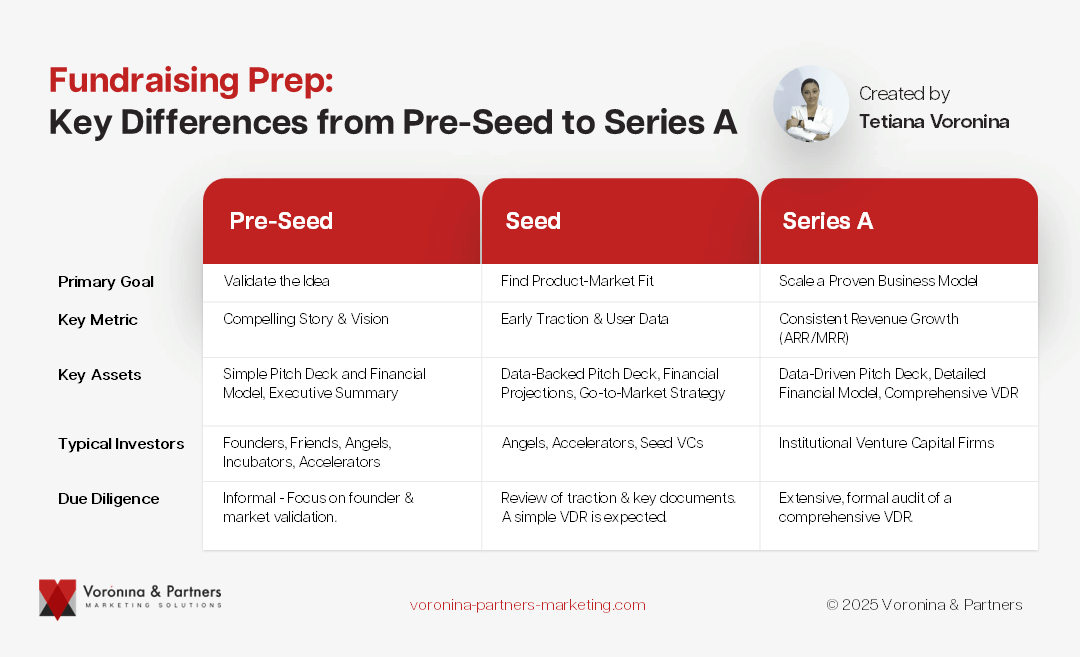

Pre-Seed vs. Seed Funding: The Key Differences

| Factor | Pre-Seed Stage | Seed Stage |

|---|---|---|

| Primary Goal | Validate the business idea | Achieve Product-Market Fit & scale |

| Company Focus | Problem/Solution, Team | Traction, Unit Economics |

| Key Metrics | Waitlist, MVP, LOIs | MRR, Churn, LTV:CAC |

| Typical Raise | $50k - $500k | $500k - $3M |

| Investors | Angel Investors, Friends & Family | VCs, Accelerators, Angels |

What is Pre-Seed Funding? The Genesis of an Idea

Pre-Seed funding is the earliest capital a startup raises. It is designed to transform a concept into a tangible plan and validate that the business idea is worth pursuing. At this stage, the company is often just an idea, and the capital is used for foundational activities.Business Stage:

Idea or Concept. You have an idea, maybe some initial research, but no product yet.Goal:

Validate the core concept and build a prototype.Company Focus:

The core activities revolve around validating the business idea, building a prototype or proof-of-concept, and conducting initial market research to understand the potential customer base and competitive landscape.Key Metrics to Show:

Traditional business metrics are scarce here. Instead, the focus is on the narrative and the team’s potential. Investors will look for:- Founder’s background and expertise: Why are you the right person to solve this problem?

- A compelling vision and story: Can you paint a picture of a future where your company is a massive success?

- Initial market research and a rough estimate of the Total Addressable Market (TAM): How big is the opportunity?

Typical Raise Amount:

Generally less than $1 million, often falling between $25,000 and $100,000.Common Use of Funds:

- Initial market research to confirm the problem you aim to solve.

- Developing a basic prototype, mockup, or proof of concept.

- Assembling the founding team and covering initial legal costs.

Potential Investors and Capital Sources:

- Founders, Friends, and Family: This is the most common source, where capital comes from the founders’ own savings and their immediate personal network.

- Incubators: These programs are designed to help “hatch” ideas. They provide resources like office space, basic mentorship, and networking opportunities, often in exchange for a small amount of equity. The focus is on idea validation and business plan development.

- Angel Investors: High-net-worth individuals who invest their own money in early-stage companies. A small number of angel investors who have a strong belief in the founder may invest at this very early stage.

What Investors Are Funding:

At this stage, investors are betting almost entirely on the team and the vision.An Important Alternative: Non-Dilutive Funding

Before giving away equity, it’s crucial for founders to explore non-dilutive capital. This is funding you receive without giving up any ownership in your company. It is an excellent way to extend your runway and hit key milestones before a formal equity round.

- Grants: This is capital provided by governments, foundations, or corporations to support research, innovation, or specific social goals.

- Government Grants: Programs like SBIR/STTR in the United States or Horizon Europe in the EU offer significant funding for deep tech and R&D-heavy companies.

- Private Foundations: Many foundations offer grants to startups aligned with their mission, particularly in areas like climate tech, health, and education.

- Other Forms: While less common at the pre-seed stage, other options include pitch competitions, which can provide cash prizes and valuable PR.

What is Seed Funding? Planting the Seeds for Product-Market Fit

A Seed round is often the first official funding stage where a startup brings in a broader network of outside investors. The core purpose of seed funding is to turn a validated concept into a viable business with early signs of traction.

How Does Seed Funding Work?

In a seed round, you are raising money to find product-market fit (PMF). The strategic objective is to make enough progress to justify a larger, subsequent funding round.

Business Stage:

You’ve moved beyond the napkin and have a Minimum Viable Product (MVP) with early signs of traction. This means you have a product in the hands of users or even a few early customers.

Goal:

Find initial signals of product-market fit.

Company Focus:

The primary goals are to achieve product-market fit, build out the core team beyond the founders, and begin to refine the business model based on early feedback.

Key Metrics to Show:

- Early user numbers and engagement metrics.

- Initial revenue (if any).

- Customer feedback and testimonials.

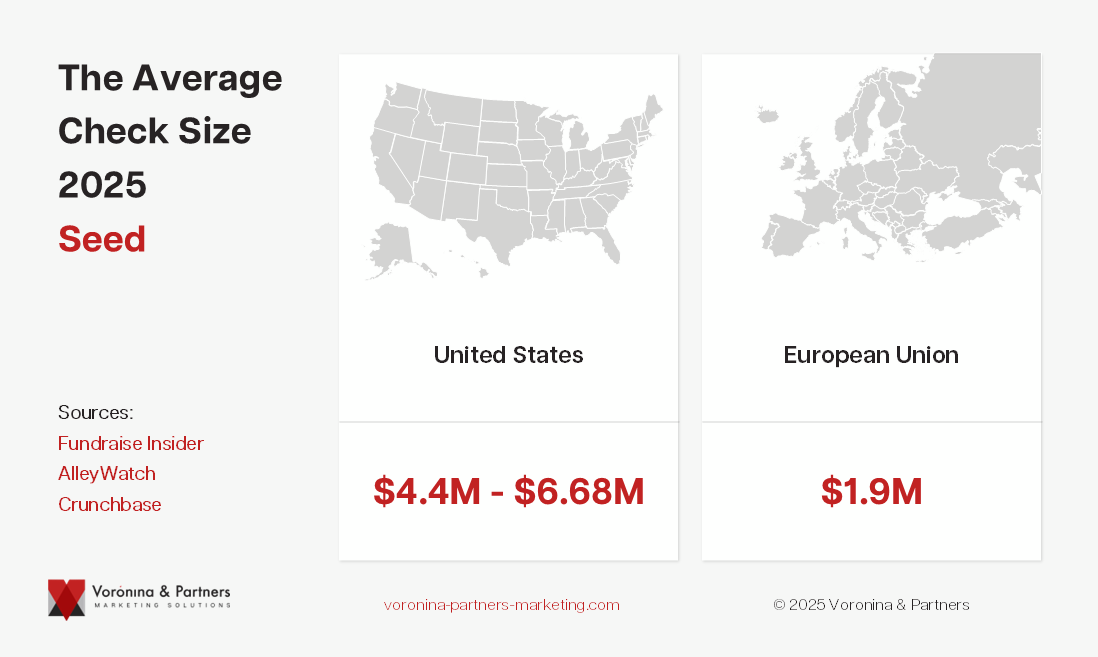

Typical Raise Amount (2025 Data):

- United States:

According to fundraising data from sources like Fundraise Insider and AlleyWatch, the average check size ranges from $4.4M to $6.68M, with the median between $3.0M and $4.18M. - European Union:

Based on reports from Crunchbase, the average check size is approximately $1.9M.

Common Use of Funds:

- Building a Minimum Viable Product (MVP).

- Hiring essential early team members.

- Acquiring the first set of early-adopter customers to generate data.

Potential Investors and Capital Sources:

- Angel Investors & Angel Groups: Individual angels continue to be key, and they often organize into groups to pool capital and share due diligence.

- Accelerators: These programs are designed to rapidly grow a startup over a fixed period (usually 3-6 months). They provide a modest investment, intensive mentorship, and a network in exchange for a small amount of equity. The program culminates in a “Demo Day” where founders pitch to a large audience of VCs and angel investors. Famous examples include Y Combinator and Techstars.

- Seed-Stage Venture Capital (VC) Funds: These are formal investment funds that specialize in leading or participating in seed rounds. They write larger checks than most angels and provide institutional support.

What Investors Are Funding:

Investors are now backing a product with demonstrated potential and a team that has shown it can execute and attract early adopters.

What are the Disadvantages of Seed Funding?

- Dilution: You are selling a piece of your company (equity).

- Pressure to Grow: Once you take outside capital, there is an explicit expectation of rapid growth.

- Signaling Risk: Failing to raise a Series A after a seed round can be a negative signal to future investors.

What is Series A Funding? The Engine for Scale

Series A funding marks a startup’s transition from an experimental phase to a growth phase. This is typically the first major round of institutional venture capital and is focused entirely on scaling a business that has already proven its model.

Business Stage:

The company has a proven business model, a strong and growing user base, and consistent, repeatable revenue generation.

Goal:

Scale a proven business model.

Company Focus:

The main objectives are to optimize the sales and marketing process, scale operations, and build a strong management team.

Key Metrics to Show:

- Consistent month-over-month revenue growth.

- Key performance indicators (KPIs) like Customer Acquisition Cost (CAC) and Lifetime Value (LTV).

- A clear and large addressable market (TAM).

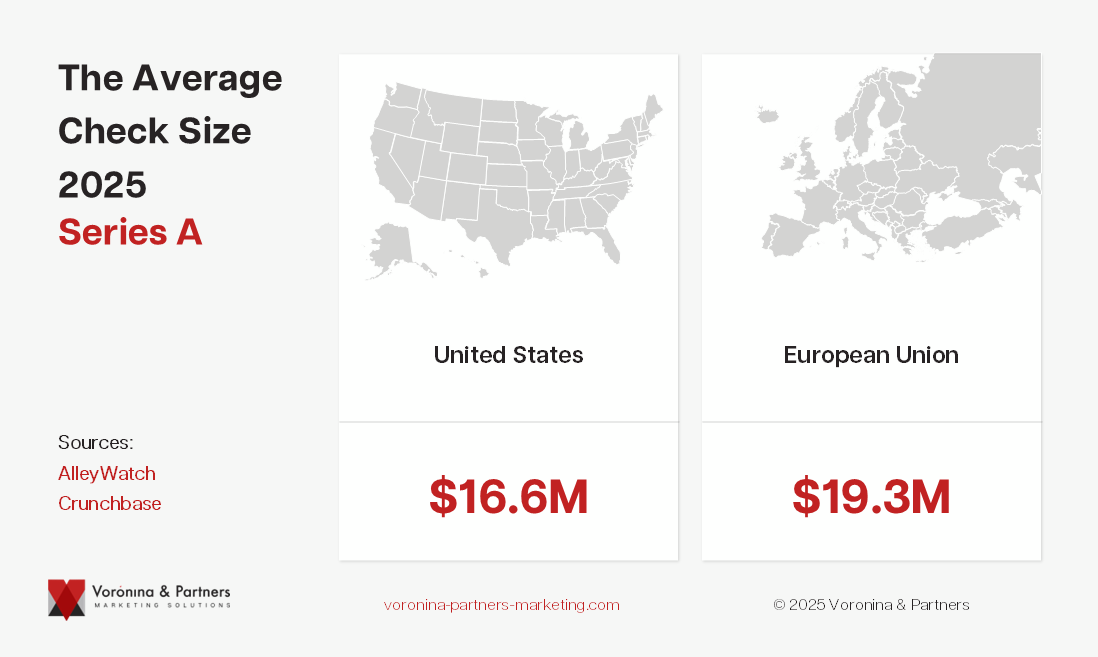

Typical Raise Amount (2025 Data):

- United States:

Per analysis from AlleyWatch, the average check size is $16.6M, with a median of $12.0M. - European Union:

According to Crunchbase data on early-stage rounds (covering Series A/B), the average is around $19.3M.

Common Use of Funds:

- Aggressively hiring sales and marketing teams.

- Scaling operations and expanding into new markets.

Investors:

This stage is dominated by institutional Venture Capital (VC) firms. A lead VC investor will take a seat on the company’s Board of Directors, giving them significant influence.

What Investors Are Funding:

VCs are investing in a business with a proven model that is ready to be scaled into a market leader.

Fundraising Prep: Key Differences

Your fundraising preparation must evolve as your company matures. The pitch deck that wins a Series A is different from the one that secures a pre-seed round, and the same is true for your financial model. The key is to prepare the right assets, with the right level of detail, for the right stage.

The Virtual Data Room (VDR): More Than a Folder, It’s a Strategic Signal

In the high-stakes world of fundraising, the Virtual Data Room (VDR) is no longer a passive folder of documents. A well-organized VDR is a powerful, proactive signal of your professionalism and operational maturity. It builds instant credibility and shows investors you are serious and respectful of their time. A messy or incomplete VDR, on the other hand, creates doubt before diligence even begins.

The contents of your VDR must be strategically aligned with your funding stage.

The Pre-Seed VDR: Validating the Vision

At this stage, your VDR is lean and focused on supporting your story.

- Pitch Deck: Your concise, compelling narrative overview.

- Executive Summary: A one-page text summary of your deck.

- Founding Team Bios: Highlights the relevant expertise and experience of the core team.

- Simple Cap Table: A clear breakdown of founder and advisor ownership.

- Financial Model: A simple 12-18 month forecast focused on your burn rate and use of funds.

- IP Agreements: Signed agreements from all founders assigning intellectual property to the company. This is non-negotiable.

The Seed VDR: Demonstrating Potential

Here, you must provide tangible evidence that you are on the path to product-market fit.

- Metrics-Informed Pitch Deck: Your evolved deck, now including early traction data and user feedback.

- Detailed Financial Projections: A 3-5 year model with monthly breakouts for the first 12-24 months.

- Product Roadmap: A document outlining the planned evolution of your product for the next 12-18 months.

- Customer Metrics Dashboard: Quantitative proof of early traction (e.g., user growth, engagement, retention, initial CAC).

- Key Customer Contracts / LOIs: Anonymized copies of your top 3-5 signed contracts or strong Letters of Intent.

The Series A VDR: Proving the Business

Your VDR now becomes an exhaustive “evidence locker” ready for rigorous, institutional due diligence.

- Data-Driven Pitch Deck: Your polished, board-ready deck, heavy on metrics and competitive positioning.

- Detailed Operating Model: Your full 3-5 year financial model, integrated with historical data and ready for deep scrutiny.

- Historical Financials: Audited statements for prior fiscal years are preferred. At minimum, internally prepared P&L, Balance Sheet, and Cash Flow statements.

- Fully-Diluted Cap Table: A complete, legally-vetted cap table, preferably from a platform like Carta.

- All Material Contracts: A comprehensive folder of all key customer, partner, and vendor agreements.

- Complete Corporate & Legal Records: All charter documents, board meeting minutes, and shareholder agreements.

From Knowledge to Fundraising: Your Next Step

Understanding the difference between Pre-Seed, Seed, and Series A is the first step. The next is building the assets that will win over investors at each stage.

A powerful, investor-ready financial model and a compelling, data-driven pitch deck are the two critical tools you need to translate your vision into a story that gets funded.

You don’t need to start from scratch. To accelerate your progress, we’ve developed a suite of DIY tools—from ex-KPMG verified financial models to a curated library of 100+ investor-proven pitch deck slides. These are toolkits designed to give you the confidence to raise capital at every stage.

Ready to Build the Pitch That Wins? Explore our suite of founder-focused, expert-verified tools.

Frequently Asked Questions (FAQ)

What is the difference between Seed and Series A funding?

Seed funding is used to find product-market fit, while Series A funding is used to scale a company that has already demonstrated product-market fit.

How long between seed funding and Series A?

The typical timeframe is 12 to 24 months, which allows a startup to use seed capital to hit the milestones required for Series A.

Can you skip seed and go to Series A?

It is rare but possible for a “bootstrapped” company with exceptional early traction to raise a Series A as its first round.

Is Series A considered early stage?

Yes, Series A is still an early-stage investment, but it marks the transition from the “startup” phase to the “growth” or “scale-up” phase.

Is pre-seed before Series A?

Yes, the funding stages are sequential: Pre-Seed -> Seed -> Series A -> Series B, and so on.

About Author

Tetiana Voronina is a Pitch Deck and Presentation Strategist, Founder and CEO of Voronina & Partners Marketing Solutions, and a YC SS19 attendee. She specializes in comprehensive fundraising preparation, crafting the compelling narratives that have cumulatively raised $125M+ in funding.