The Ultimate Startup Data Room Checklist (2025 Guide)

Tetiana Voronina

Pitch Deck & Presentation Strategist with a $125M+ Track Record | YC SS19

The pitch was a success. The investors are hooked on the vision. They see the market-defining opportunity.

Then comes the single most important request of your fundraising journey:

“This is compelling. Can you send over the data room?”

This isn’t just a request for a link. It’s a test of your operational discipline. For investors, the quality of a data room for startups is a direct reflection of the founders’ professionalism, and it’s where promising deals often begin to die, silently.

The best founders understand that a VDR is more than a folder. It’s a strategic weapon. It continues the work of the pitch – shaping the investor’s narrative, guiding their attention, and proving you have the discipline to execute.

This guide provides the ultimate downloadable checklist to ensure your data room sends the right signal and closes the deal.

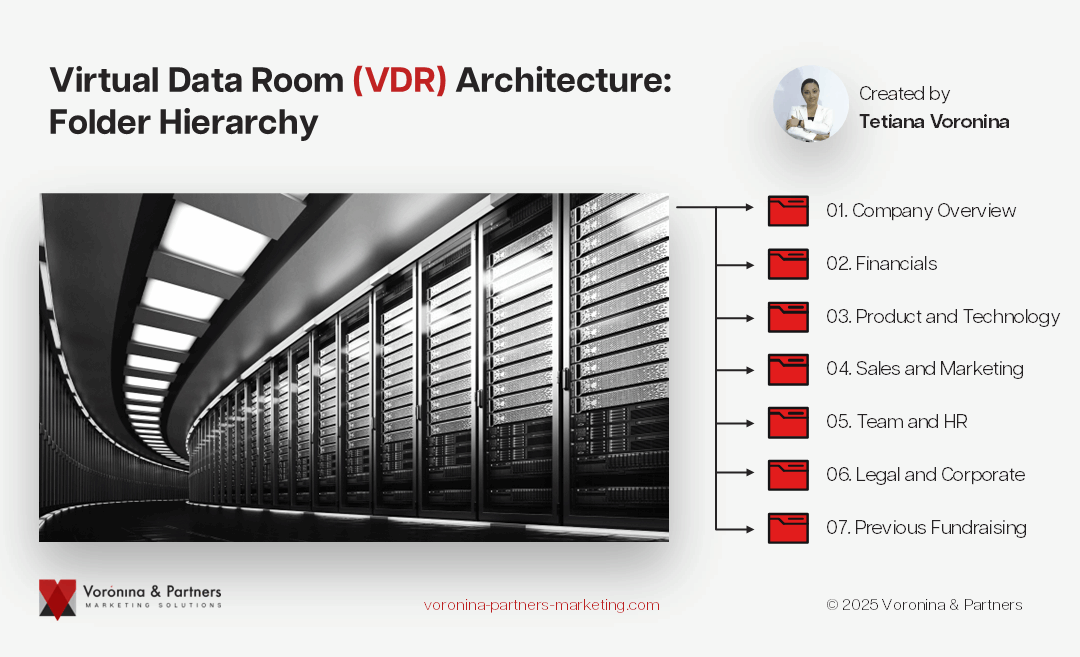

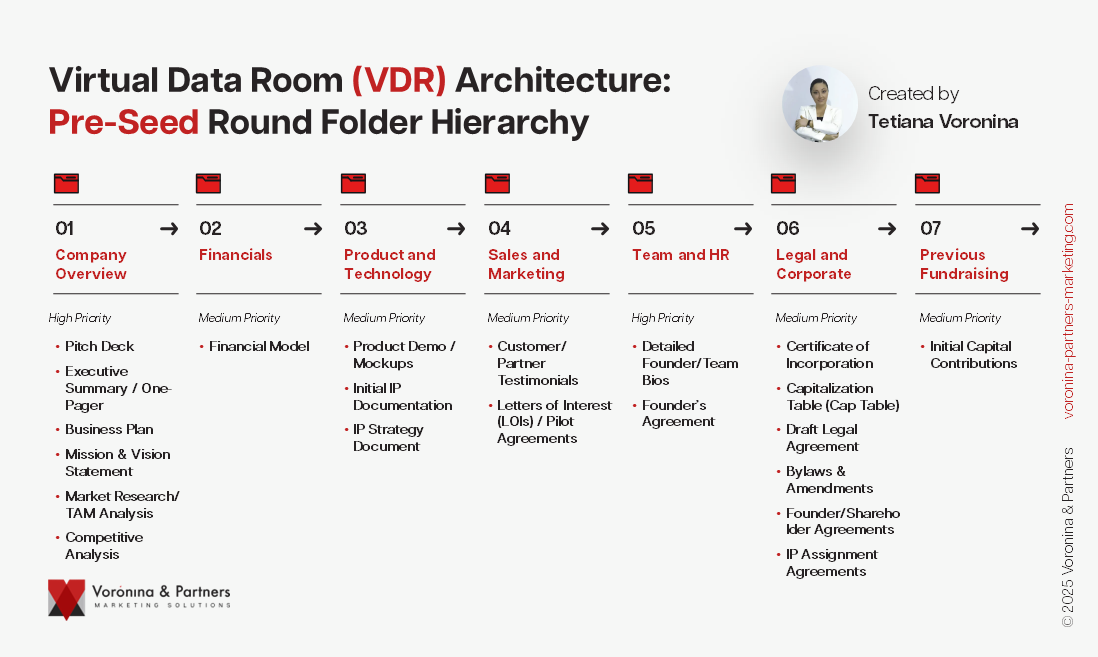

The Pre-Seed VDR Checklist: Validating the Vision

Building the first data room for startups at the Pre-Seed stage is fundamentally different from later rounds. You have more vision than traction. Therefore, its purpose isn’t to showcase complex metrics, but to meticulously support and substantiate the narrative from your pitch deck.

The key question it must answer is: “Why this team, and why this market, right now?”

Company & Vision (High Priority)

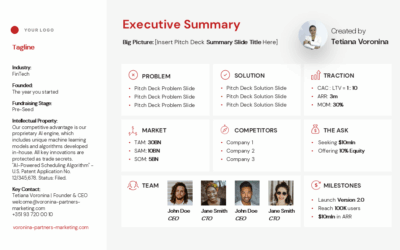

- Pitch Deck: The primary narrative document outlining the problem, solution, market, team, and vision.

- Executive Summary / One-Pager: A concise, one-page summary of the business for quick review.

- Business Plan: A high-level document detailing the company’s mission, vision, strategy, and initial operational plan.

- Mission & Vision Statement: A clear articulation of the company’s long-term purpose and goals.

Team (High Priority)

- Detailed Founder/Team Bios: More than just a resume, these bios should highlight relevant domain expertise, past accomplishments, and the unique skills that make this team suited to solve the target problem.

- Founder’s Agreement: An agreement between the co-founders that outlines equity splits, roles, responsibilities, and, most importantly, vesting clauses. This signals alignment and protects the company from early founder departures.

Market & Problem (High Priority)

- Market Research: Independent data and analysis demonstrating the size of the Total Addressable Market (TAM), market trends, and the existence of a clear market gap or need.

- Competitive Analysis: An initial overview of the competitive landscape, identifying direct and indirect competitors and the startup’s proposed differentiation.

Product & IP (Medium Priority)

- Product Demo / Mockups: If a product is not yet built, visual mockups, wireframes, or process flow diagrams can effectively communicate the product vision.

- Initial IP Documentation: If the business is founded on a specific piece of intellectual property, any provisional patent filings, IP contracts, or legal opinions should be included to demonstrate defensibility.

Early Validation (Medium Priority)

- Customer/Partner Testimonials: Positive feedback from potential users, even from informal conversations or surveys, can provide powerful social proof.

- Letters of Interest (LOIs) / Pilot Agreements: Non-binding commitments from potential customers or partners are a strong signal that the market wants the proposed solution.

Corporate & Financial (Medium Priority)

- Certificate of Incorporation: Proof that the company has been legally formed.

- Capitalization Table (Cap Table): A simple table showing the ownership structure, which at this stage likely only includes the founders.

- Financial Model: A simple spreadsheet showing the proposed use of funds from the Pre-Seed round, projected monthly burn rate, and the resulting cash runway.

The Deal (Medium Priority)

- Draft Legal Agreement: Including a draft of the fundraising instrument, such as a SAFE (Simple Agreement for Future Equity) or a Convertible Note, demonstrates preparedness and can expedite the closing process

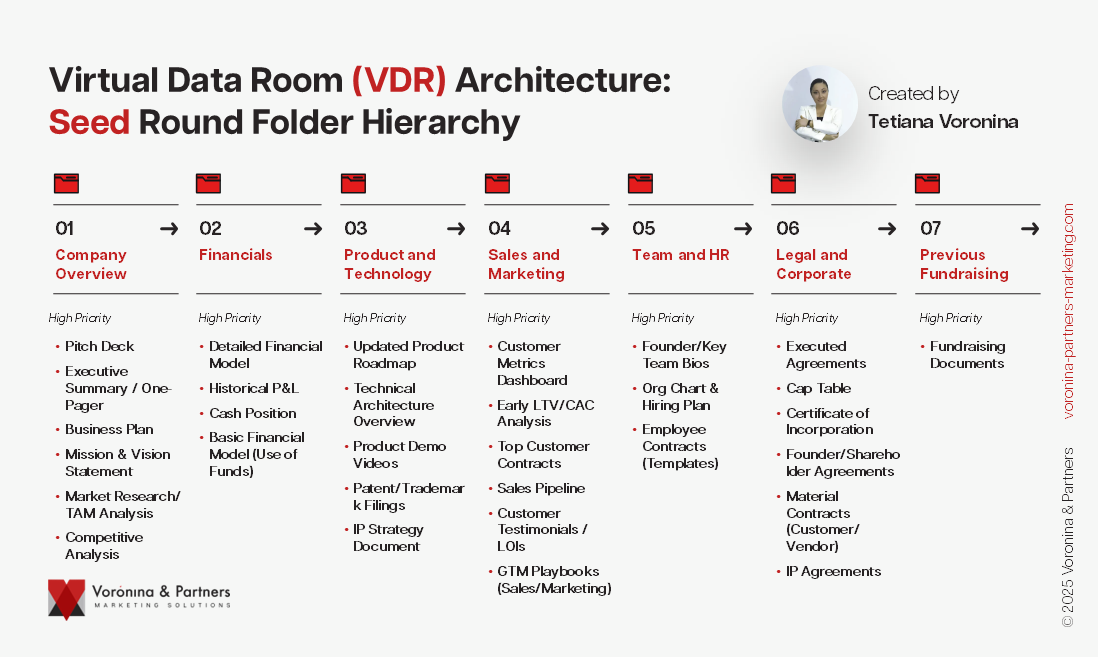

The Seed VDR Checklist: Demonstrating Initial Traction

The narrative at the Seed stage must evolve from “this could work” to “this is starting to work.” Investors are now looking for the first concrete evidence of Product-Market Fit (PMF). Your VDR must provide data that substantiates claims of user adoption and engagement, bridging the gap between a qualitative story and quantitative evidence.

Traction & Metrics (High Priority)

- Usage Data / Customer Metrics Dashboard: A dashboard or spreadsheet showing key performance indicators (KPIs) such as Monthly Active Users (MAU), user growth rates, session times, and other relevant engagement metrics.

- Early LTV/CAC Analysis: A preliminary calculation of Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC). While this will be based on limited data, it demonstrates financial discipline and an understanding of unit economics.

- Top Customer Contracts: Anonymized copies of the top 3-5 customer contracts to validate revenue and terms.

- Sales Pipeline: An overview of the current sales pipeline, showing potential deals and their stages.

Financials (High Priority)

- Detailed Financial Model: An updated financial model with monthly projections for the next 18-24 months, clearly outlining assumptions for revenue growth, hiring, and expenses.

- Historical P&L: A profit and loss statement showing monthly performance to date.

- Cash Position: A clear statement of the current cash balance, monthly burn rate, and calculated runway.

Product (High Priority)

- Updated Product Roadmap: A document outlining the planned product development and feature releases for the next 12-18 months.

- Technical Architecture Overview: A high-level diagram or description of the technology stack and system architecture.

- Product Demo Videos: Professionally produced videos demonstrating the product’s core functionality and value proposition.

Legal & Corporate (High Priority)

- Executed Agreements: Fully executed employment agreements and proprietary information and invention assignment (PIIA) agreements for all founders and employees, confirming that all intellectual property is owned by the company.

- Updated Cap Table: A complete and accurate capitalization table that includes all founders, employees with equity, and any convertible instruments (SAFEs, notes) issued during the Pre-Seed round.

- Corporate Documents: The company’s official Bylaws and any Shareholder Agreements.

Previous Funding (High Priority)

- Fundraising Documents: Copies of all signed SAFE or Convertible Note agreements from the Pre-Seed round.

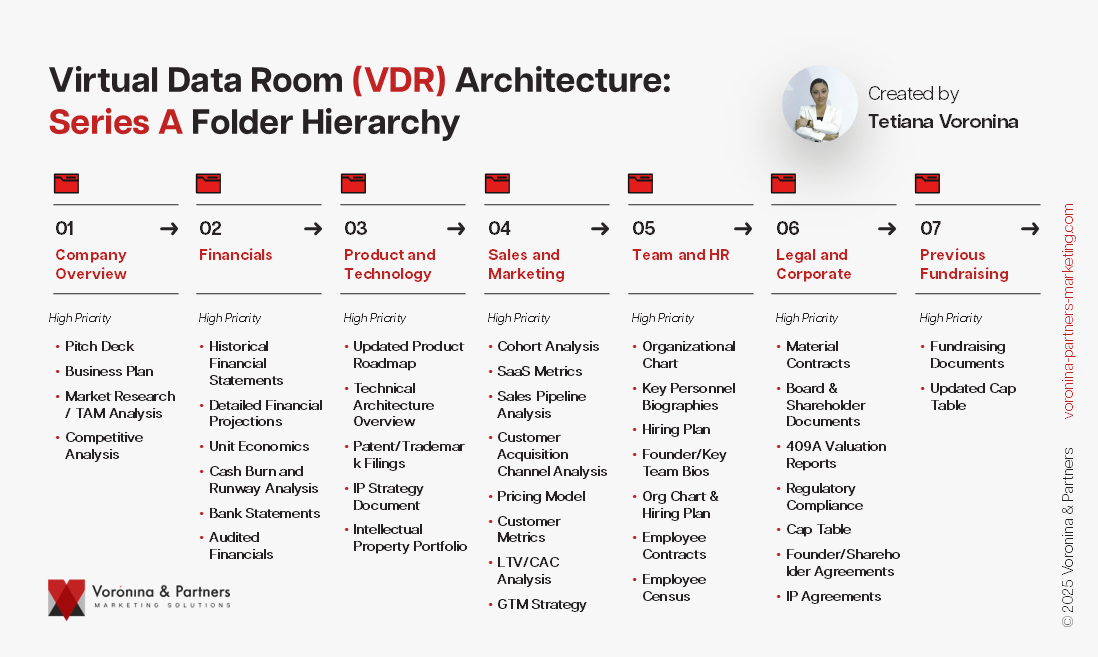

The Series A VDR Checklist: Proving the Business

The Series A round is where a startup must prove it has transitioned from searching for a business model to executing on one. The expectations for a data room for startups shift dramatically here; it must become a rigorously data-driven testament to your progress, providing undeniable evidence of Product-Market Fit (PMF) and a repeatable Go-to-Market (GTM) strategy.

Financials (High Priority)

- Historical Financial Statements: Formal Profit & Loss Statement, Balance Sheet, and Cash Flow Statement, presented on a monthly basis for at least the last 12-24 months.

- Detailed Financial Projections: A robust, driver-based financial model forecasting performance for the next 3 years, with monthly detail for the first year and quarterly thereafter. The model’s assumptions must be clearly articulated.

- Cash Burn and Runway Analysis: A detailed breakdown of the current and projected net cash burn, along with the calculated runway based on the requested funding amount.

- Bank Statements: Upon request, bank statements for the previous 6 months may be required to reconcile with the company’s financial statements.

Metrics & KPIs (High Priority)

- Cohort Analysis: Detailed analysis of customer cohorts (typically by sign-up month) showing user retention, revenue retention (including Net Dollar Retention – NDR), and gross margin retention over time.

- Unit Economics: A rigorous analysis of LTV/CAC and CAC payback period, ideally segmented by customer acquisition channel or customer type.

- SaaS Metrics (if applicable): A dashboard tracking key SaaS metrics such as Annual Recurring Revenue (ARR), Monthly Recurring Revenue (MRR), Gross Margin, and customer churn (logo and revenue).

- Sales Pipeline Analysis: A detailed report from the company’s CRM showing the current sales pipeline, conversion rates by stage, and average deal size.

Go-to-Market (High Priority)

- Marketing & Sales Strategy: Documents outlining the company’s GTM strategy, including target customer profiles, marketing programs, and sales processes.

- Customer Acquisition Channel Analysis: Data showing the performance and cost-effectiveness of different acquisition channels (e.g., paid marketing, content, direct sales).

- Pricing Model: A detailed explanation of the company’s pricing structure, including different tiers and historical pricing changes.

Legal & Corporate (High Priority)

- Material Contracts: Copies of all material agreements, which typically includes key customer contracts, strategic partnership agreements, and any vendor or supplier contracts with obligations over a specified threshold (e.g., $20,000).

- Intellectual Property Portfolio: A complete schedule of all patents (filed and granted), trademarks, and copyrights. This must be accompanied by proof of IP assignment (PIIA agreements) from 100% of current and former employees and consultants.

- Board & Shareholder Documents: All board of directors meeting minutes and written consents since inception. This also includes all key corporate records such as the articles of incorporation, bylaws, and shareholder agreements.

- 409A Valuation Reports: Copies of the last one or two 409A valuation reports, which are used to set the strike price for employee stock options.

- Regulatory Compliance: Documentation demonstrating compliance with any relevant industry-specific regulations.

Team (Medium Priority)

- Organizational Chart: A formal org chart showing the current team structure.

- Key Personnel Biographies: Short bios for key members of the leadership team.

- Hiring Plan: A detailed plan for key hires to be made with the proceeds from the Series A round.

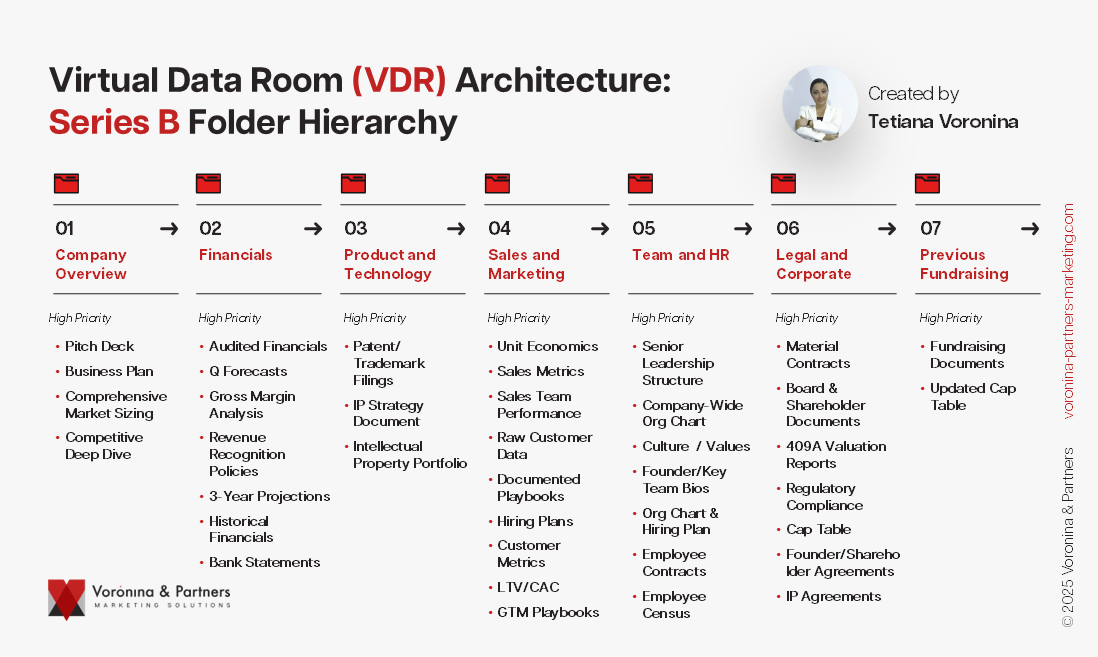

The Series B VDR Checklist: Validating the Go-to-Market Machine

At the Series B stage, the investment thesis shifts. The key question is: “Can this company efficiently deploy a significant amount of capital to accelerate predictable growth?” The VDR must prove that the company has a well-oiled Go-to-Market (GTM) engine that is ready for a major injection of fuel. Investors need to see systems, processes, and playbooks that can scale independently of the founding team.

Financials (High Priority)

- Audited Financials: Audited financial statements for the last two fiscal years, or at a minimum, financials that are “audit-ready.” This demonstrates strong internal financial controls.

- Quarterly Forecasts: Detailed quarterly financial forecasts for the upcoming three years, tightly linked to the operational plan.

- Gross Margin Analysis: A detailed breakdown and analysis of gross margins, showing trends over time and by product/service line.

- Revenue Recognition Policies: A formal document outlining the company’s revenue recognition policies, which becomes increasingly important for subscription or complex contract-based businesses.

Operational Metrics (High Priority)

- Granular Unit Economics: A deeper dive into unit economics (LTV, CAC, Payback), segmented by customer type, geography, and acquisition channel to identify the most profitable segments.

- Sales Efficiency Metrics: Calculation and historical tracking of key sales efficiency metrics like the “Magic Number” (change in quarterly subscription revenue / prior quarter’s S&M expense) and CAC Payback period.

- Sales Team Performance: Data on historical sales representative quota attainment, average time for a new representative to ramp to full productivity, and sales pipeline coverage ratios needed to hit targets.

- Raw Customer Data: An anonymized, raw data file (e.g., CSV or Excel) of customer MRR data, including contract start date, initial MRR, and current MRR. This allows investors to conduct their own cohort and retention analysis.

Go-to-Market Playbooks (High Priority)

- Documented Playbooks: Formal, documented playbooks for the sales, marketing, and channel partnership functions. These should detail processes, scripts, strategies, and best practices, proving the GTM motion is systematized.

- Detailed Hiring Plans: Specific hiring plans for the Sales and Marketing organizations, including roles, levels, and expected timing, directly tied to the financial forecast.

Strategy & Market (High Priority)

- Comprehensive Market Sizing: A detailed market size analysis that includes both a top-down (industry reports) and a bottom-up (customer-based) calculation to provide a more robust and defensible TAM estimate.

- Competitive Deep Dive: A thorough competitive analysis that includes not only a list of competitors but also a feature-by-feature mapping and a clear articulation of the company’s sustainable competitive advantages.

- Customer References: A list of key customers who have agreed to act as references for due diligence calls with potential investors.

Team & Culture (Medium Priority)

- Senior Leadership Structure: An overview of the senior leadership team, their roles, and their reporting structure. Investors will often want to meet these functional leaders post-term sheet.

- Company-Wide Org Chart: A complete organizational chart, broken down by function, showing the current state and planned evolution of the organization post-funding.

- Culture Deck / Values Presentation: A presentation that provides an overview of the company’s mission, vision, and core values, demonstrating a deliberate approach to building a strong company culture.

Legal & Governance (High Priority)

- Complete Board Records: All board meeting minutes, presentations (board decks), and written consents.

- Legal Disputes: A summary of any past, present, or pending legal disputes or litigation.

- Regulatory & Compliance: Documentation of compliance with all relevant industry-specific regulations, especially in sensitive sectors like finance, healthcare, or data privacy.

The Series C VDR Checklist: Scaling the Enterprise

By Series C, a startup is a recognized scale-up. The investment narrative centers on cementing market leadership, demonstrating a clear path to profitability, and executing on strategic expansion (e.g., new products, international markets). Diligence at this stage reflects a “public-company readiness” mindset, scrutinizing internal controls and financial reporting maturity.

Financials (High Priority)

- Audited Financials: Three years of audited financial statements are often standard at this stage.

- Budget vs. Actuals Analysis: Detailed analysis comparing historical financial performance against the budgets and forecasts presented to the board, demonstrating forecasting accuracy and operational control.

- Sophisticated Forecast Model: A detailed 3-5 year financial model, often with capabilities for scenario analysis and sensitivity testing.

- Revenue Diversification Analysis: A breakdown of revenue by product line, customer segment, and geography to assess concentration risk and growth drivers.

Corporate Governance (High Priority)

- Formal Board Committee Documentation: Charters and meeting minutes for established board committees, such as the Audit Committee and Compensation Committee.

- Directors & Officers (D&O) Insurance: Details of the company’s D&O liability insurance policy.

- Detailed Cap Table Modeling: A sophisticated capitalization table that can model out various financing and exit scenarios, showing the impact on all classes of stock and their respective liquidation preferences.

Operational Excellence (High Priority)

- COGS and Operating Expense Analysis: A detailed breakdown and analysis of the Cost of Goods Sold (COGS) and all major operating expense categories.

- Departmental Budgets: The current and historical budgets for each major department within the organization.

- Workforce Analytics: Data on workforce demographics, employee turnover rates, and employee satisfaction reports (if available).

- Leadership Succession Planning: Documentation or discussion of plans for key leadership roles to mitigate “key person” risk.

Strategic Initiatives (High Priority)

- Expansion Plans: Detailed strategic plans for any proposed entry into new markets (geographies) or new product lines.

- M&A Pipeline: If applicable, an overview of the company’s strategy and pipeline for potential acquisitions.

- Growth Initiatives Deep Dive: A presentation or memo providing a detailed look into the key growth initiatives that the Series C funding will accelerate.

Legal & Compliance (High Priority)

- Comprehensive Contract Review: A complete repository of all material contracts, organized and summarized for efficient review.

- International Compliance: If the company operates internationally, documentation related to compliance with local laws, labor regulations, and tax structures.

- Data Privacy & Security Policies: Formal policies and documentation related to data privacy (e.g., GDPR, CCPA compliance) and information security, including any third-party security audits or certifications (e.g., SOC 2).

The Series D+ VDR Checklist: Path to Market Leadership & Liquidity

Fundraising at Series D and beyond represents pre-IPO growth equity. The company is an established market leader, and the narrative is focused on market domination and a clear, near-term path to liquidity. Diligence is forensic, as investors seek to uncover any hidden liabilities that could jeopardize a large-scale investment.

Financials (High Priority)

- Audited Financials: 3-5 years of audited financial statements are standard.

- Quality of Earnings (QoE) Report: Investors may commission or request a QoE report from a third-party accounting firm to analyze the sustainability and accuracy of historical earnings.

- Detailed Cohort-Based LTV Models: Highly sophisticated models for calculating customer lifetime value, based on extensive historical cohort data.

- Gross Margin by Product Line: A granular analysis of gross margins for each distinct product or service line to understand profitability drivers.

Market & Competitive Landscape (High Priority)

- Third-Party Market Reports: Independent market analysis reports to validate the company’s TAM and growth projections.

- SWOT Analysis: A detailed Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis, often prepared with input from external consultants.

- Market Share and Defensibility Analysis: A rigorous analysis of the company’s current and projected market share, and the defensibility of its competitive moat.

Exit Preparedness (High Priority)

- Draft S-1 Components: If the company is on an IPO track, early drafts of key sections of the S-1 registration statement may be included.

- Analysis of Potential Acquirers: A strategic analysis of potential M&A acquirers and potential synergies.

- Exit Strategy Documentation: A formal document outlining the board’s and management’s preferred exit strategy and timeline.

Tax & Legal (High Priority)

- Comprehensive Tax Records: Federal, state, local, and international tax returns for the last 3-5 years.

- Tax Audit History: A complete history of any tax audits and all correspondence with tax authorities (e.g., IRS).

- Transfer Pricing Documentation: For companies with international operations, detailed transfer pricing studies and documentation are required.

IT & Security (High Priority)

- IT Infrastructure Maps: Detailed diagrams of the company’s full IT architecture, including networks, servers, and data centers.

- Disaster Recovery & Business Continuity Plans: Formal, tested plans for disaster recovery and business continuity.

- Data Security Audits: Reports from any third-party information security audits (e.g., penetration tests, SOC 2 reports).

- Software Inventory: A complete list of all software used by the company, along with corresponding license agreements.

Human Resources (High Priority)

- Full Employee Census: An anonymized list of all employees showing role, location, tenure, and compensation.

- Compensation Philosophy: Documents outlining the company’s compensation structures, including salary bands, bonus plans, and equity grant policies.

- Labor Relations: Details of any labor union agreements or past/present employee-related litigation.

The Exit VDR Checklist: M&A and IPO

When a company prepares for an exit, the VDR becomes the central, legally-defensible platform for the entire transaction. Its purpose shifts from fundraising to facilitating exhaustive, third-party due diligence.

The M&A VDR Checklist: Preparing for Acquisition

In a sell-side M&A process, the VDR’s audience is a prospective acquirer and their extensive team of advisors. The narrative is no longer about future growth, but about comprehensively justifying a purchase price and de-risking the transaction for the buyer.

Internal Process Documents (Seller Team Access Only)

- Buyer List: A spreadsheet tracking the long-list and short-list of potential strategic and financial buyers.

- Process Tracker: A document outlining the status of outreach, NDAs signed, and progression of each potential buyer through the stages of the auction process.

Initial Marketing Materials (For Buyers with Signed NDAs)

- Teaser: A one or two-page anonymous summary of the company used for initial outreach.

- Confidential Information Memorandum (CIM): A detailed marketing book (typically 50-100 pages) prepared by the investment bank that tells the company’s story, details its operations, and presents its financial profile.

- Third-Party Valuation Report: An independent valuation of the business, often included to anchor price expectations.

Corporate

- Full Corporate Structure: A detailed organizational chart showing the target company and all legal subsidiaries and affiliates.

- Minute Books & Stock Ledgers: Complete, unabridged minute books and stock ledgers for the company and all subsidiaries since inception.

- Formation Documents: Articles of Incorporation, Bylaws, and all amendments for all legal entities.

- Shareholder Agreements: All current and historical shareholder, voting, and investor rights agreements.

Financial

- Historical Financials: At least 5 years of audited financial statements, if available. Unaudited statements for interim periods.

- QoE Report: A Quality of Earnings report is often prepared proactively by the seller or will be a key diligence item for the buyer.

- Granular Financial Data: Detailed financial data exports to allow the buyer to build their own financial model.

- Off-Balance Sheet Items: A schedule and description of all off-balance sheet liabilities or obligations.

Commercial

- Customer Analysis: Lists of top customers by revenue for the last 3 years, showing revenue concentration. A list of any material customers lost in the last 12 months.

- Customer & Vendor Contracts: Copies of all significant customer and supplier contracts.

- Sales & Marketing: Detailed sales pipeline reports, marketing plans, and analysis of commercial strategies.

Human Resources

- Employee Census: A detailed, anonymized census of all employees showing role, location, salary, bonus, hire date, and other relevant data.

- Employment Agreements: Copies of all employment, consulting, non-compete, and severance agreements.

- Benefit Plans: All documentation for employee benefit plans (health, retirement, equity).

- HR Policies & Disputes: Employee handbooks, HR policies, and a summary of any past or present employee claims or litigation.

Legal & Regulatory

- All Material Contracts: A repository of every contract deemed material to the business.

- Litigation Summary: A detailed summary of any past, present, or threatened litigation.

- Permits & Licenses: Copies of all governmental permits, licenses, and consents necessary to operate the business.

- Environmental Reports: Any environmental, health, and safety audits, reports, or correspondence with regulatory agencies.

Intellectual Property

- IP Schedule: A complete schedule of all owned and licensed patents, trademarks, copyrights, and domain names.

- IP Agreements: Copies of all IP-related agreements, including licenses, royalty agreements, and settlement agreements.

- IP Disputes: A summary of any actual or alleged instances of IP infringement, either by the company or against the company.

IT & Assets

- Asset Inventory: A full inventory of all physical assets, including real estate (leases and deeds) and major equipment.

- IT Systems: A summary of all key IT resources, software policies, and details of any major IT initiatives.

- Security & Privacy: IT architecture diagrams, cybersecurity policies, data privacy policies, and disaster recovery plans.

Tax

- Tax Returns: At least 5 years of federal, state, local, and international tax returns.

- Audit History: A summary of all tax audits and the resolution of any findings.

- Tax Agreements: Copies of all material communications and agreements with any taxing authority.

The IPO VDR Checklist: Preparing for the Public Market

For an Initial Public Offering (IPO), the VDR becomes the internal workspace for the entire IPO working group (management, lawyers, underwriters, auditors). Its primary function is to serve as the single source of truth for drafting and verifying the Form S-1 registration statement for the SEC.

Corporate Housekeeping & Governance

- Public Company Formation Documents: Drafts and final versions of the Amended & Restated Certificate of Incorporation and Bylaws that will be effective upon the IPO closing.

- Board & Committee Documentation: Finalized charters for the Audit, Compensation, and Nominating & Governance committees, compliant with exchange listing standards.

- Corporate Governance Policies: A suite of policies required for public companies, including a Code of Business Conduct and Ethics, Insider Trading Policy, Regulation FD (Fair Disclosure) Policy, and Related-Party Transaction Policy.

- D&O Questionnaires: Completed questionnaires from all directors and officers, used to verify independence, background information, and potential conflicts for the S-1 disclosure.

S-1 Content Back-up & Verification

- This is the core of the IPO VDR. A folder is created for nearly every factual statement, number, and claim made in the S-1, containing the source documentation used for verification (the “back-up”).

- Risk Factors: Memos, market data, and internal analyses supporting each disclosed risk factor.

- Management’s Discussion & Analysis (MD&A): The financial models, board reports, and internal operational analyses that form the basis of the MD&A section.

- Business Section: All material contracts, third-party market reports, product roadmaps, and competitive analyses cited in the business description.

- Executive Compensation: All employment agreements, bonus plans, equity award agreements, and compensation committee reports needed for the compensation disclosure.

- Related Party Transactions: Detailed documentation and analysis of all transactions between the company and its officers, directors, or major shareholders.

Financial Statements & Audit

- Audited Financials: All audited financial statements required for the S-1 filing (typically two or three years).

- Auditor Communications: All communication with the independent auditors, including engagement letters and, most importantly, drafts and the final version of the comfort letter provided to the underwriters.

Exhibits

- A complete, organized file of all material contracts that must be filed as public exhibits to the S-1. This includes the underwriting agreement, key customer agreements, major debt instruments, and equity plans.

- Confidential Treatment Requests (CTRs): The formal requests submitted to the SEC to redact competitively sensitive information from the publicly filed material contracts.

Legal & Underwriting

- Underwriting Agreement: All drafts and the final executed version of the agreement between the company and the investment banks underwriting the offering.

- Lock-Up Agreements: Executed lock-up agreements from all required directors, officers, and shareholders, restricting them from selling shares for a specified period post-IPO (typically 180 days).

- Legal Opinions: Drafts and final versions of all required legal opinions, including the crucial Exhibit 5.1 opinion from company counsel on the validity of the shares being issued.

- FINRA Filings: All documents filed with the Financial Industry Regulatory Authority (FINRA) related to the underwriting arrangements.

Process Management

- Working Group List: A complete contact list for all parties involved in the IPO process.

- Timeline and Responsibility Chart: A detailed project plan outlining all tasks, responsible parties, and deadlines for the entire IPO process.

- S-1 Drafts: All versions of the S-1 registration statement, showing the evolution of the document through the drafting process.

- SEC Correspondence: All confidential submissions to the SEC, the resulting SEC comment letters, and the company’s formal response letters.

Conclusion: A Record of Excellence

The most successful founders treat their VDR as a continuous, disciplined process – a living record of the company’s legal, financial, and operational health. The discipline required to maintain a high-quality data room for startup is the same discipline required to build an enduring company. It reflects a commitment to transparency, organization, and operational excellence.

By embedding VDR management into the regular cadence of your business, you are not just preparing for your next fundraise; you are building a fundamentally more valuable enterprise.

Master your data room.

Download the extended VDR checklist.

Take control of your fundraising narrative. Get the VDR Checklist with all the details to ace any funding round or exit.

Startup Data Room FAQs

Why do I need a formal VDR for an early-stage round?

A professional VDR is a powerful signal of your seriousness and credibility. It shows investors you are organized and respectful of their time, which builds crucial trust before they even read your financials.

What's the most common mistake founders make with their data room?

The most common mistake is sharing everything at once. A strategic VDR uses “progressive disclosure,” sharing information in stages as investor interest becomes more serious. This protects your confidential data and keeps the investor focused.

What is the difference between a deal room and a data room?

The terms are often used interchangeably. Traditionally, a “data room” is a static repository for due diligence documents. A “deal room” (like our Fundraising Hive) is a more modern, active workspace that often includes the data room plus other tools like an investor CRM.

Can I use Google Drive as a data room?

While it’s possible for very informal, early-stage sharing, it is not recommended for a serious fundraise. Google Drive lacks the essential security features, investor activity tracking, and professional presentation of a dedicated VDR or a structured Notion system.

How much does a data room cost?

Dedicated, enterprise-grade VDR platforms can cost anywhere from $200 to over $1,000 per month. This is why a well-structured DIY solution, like our Fundraising Hive, offers a much more cost-effective and powerful alternative for early-stage founders.

About Author

Tetiana Voronina is a Pitch Deck and Presentation Strategist, Founder and CEO of Voronina & Partners Marketing Solutions, and a YC SS19 attendee. She specializes in comprehensive fundraising preparation, crafting the compelling narratives that have cumulatively raised $125M+ in funding.